This Week in Apps #114 - Lots of Turbulence Ahead

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (30 Day)

Insights

1. Where's Wordle? Applovin Bought It, but Was It worth It?

Remember Wordle, the simple word game that took the internet (and eventually the App Store) by storm back in January? If so, you probably also remember the "other" Wordle, a mobile game with the same name created back in 2016 that became the most downloaded game in the US for a while.

Well, fast forward a few months, and the sensation is somewhat over. The New York Times acquired the official web game, and downloads of the other Wordle were on the decline.

But then ad network AppLovin decided it was time to get busy and very quietly acquired Wordle. So quiet most news outlets that would normally notice immediately didn't even realize until about a month after.

Was it worth it?

Let's have a look at downloads! I'd normally look at revenue to answer such a question, but AppLovin is an ad network that cares about eyeballs for its ads.

The game changed hands in early April. Although both the developer and AppLovin were very quiet about the transaction, looking at when the app's publisher name changed in the App Store gave it away. And by April, it was obvious demand was shrinking fast.

Daily downloads, which got close to 200,000 almost every day for all of February, got cut to less than half by the end of March.

A great time to get out if you're the developer and can make a chunky exit, and potentially a good time for an ad network with infinite ad spend on a still hot topic.

As soon as the game changed hands, downloads spiked and remained high for a few weeks. But the sharp increase was met with a sharp decrease. If you're thinking, this can't be organic, you're most likely correct. I think this was pure ad spend.

What surprised me is that after the sharp decline, there were no more ads, or not enough at least to sustain downloads, and the decline from March continued at pretty much the same rate. If you squint, you can see the trend from March continuing as soon as the ad-supported bump ended.

So, was it worth it? I don't think so, but I can't really fault AppLovin for trying. Who knew the trend would end as abruptly as it started?

2. Airbnb is No Longer the King of Short-Term Rentals...

Airbnb has made an amazing comeback in the last month. After having downloads disappear due to lockdowns in early 2020, the short-term rental platform saw downloads rally in 2022, hitting new all-time highs.

But... a competing app has seen downloads rising as well, and in the last few months, has been consistently beating Airbnb in the US.

Vrbo, the "Wish version of short-term rentals", as some on the internet dubbed it, looks and operates much like Airbnb. The site isn't as sleek (especially not when compared to the new Airbnb) and there aren't as many listings, but that's not stopping Vrbo, which is owned by Expedia, from outpacing Airbnb in terms of downloads.

In January, the pair saw a similar number of downloads in the US. Our estimates put daily downloads at an average of 28,000 back in January.

Fast forward to May, and daily downloads peaked at more than double for Airbnb, hitting 68,000. But Vrbo was way ahead, peaking at 120,000 downloads just a few days before. That's a lot of downloads!

The obvious trend is obvious, people want to leave their houses and apartments and live in other people's houses and apartments for a while. I looked at a few other real-world apps that are seeing massive growth in downloads for the same reason.

But the less obvious trend here is that Airbnb has competition for the first time in a long time. Pre-pandemic, Vrbo was seeing about a third of Airbnb's downloads on a daily basis, and that trend didn't veer off at all. Vrbo overtook Airbnb for short periods of time in 2020 and 2021, but those were very short. This time it's different.

It could be that demand is simply higher than Airbnb's supply or that Vrbo is spending more on ads, but overall, it means Airbnb is no longer the only game in town. I hope that means we'll get better customer service.

3. Is the Ride Over for Twitch?

Twitch has had a great run over the last few years. The streaming platform for gamers that's owned by Amazon was growing rapidly and seemed unbeatable. Then came COVID lockdowns, and Twitch was now being used for more than just games.

Downloads are nice, but if you've been following the newsletter for long enough, you know my thoughts about these platforms – it's all about creators. Twitch has a simple incentive for creators. It lets viewers reward streamers.

In 2020, in-app purchases across the App Store and Google Play in the US grew by 350%, from around $3.9 million in net revenue in January to $18 million in net revenue in December, according to our estimates.

Things got even better in 2021. Our estimates show that Twitch's net revenue in the US grew to $27 million in March and April. That's nearly 6 times higher than January of 2021.

But in October of 2021, a massive hack resulted in a big leak that exposed how much Twitchers were earning, and the good run ended.

Revenue dropped almost instantly, and Twitch was unable to recover, ending 2021 with $13 million in net revenue in the US, according to our estimates. A half of March!

Things didn't get better in 2022 either. In fact, April's revenue in the US was lower than January of 2021. Just $3.7 million of net revenue.

Can Twitch recover? I think the answer isn't a hard no, but it's also not a definite yes. Why? Because YouTube saw the opportunity and has been focusing more of its attention on gamers adding features that Twitch had and enticing them to switch over because it has more ways to monetize.

And why is YouTube so determined? Because TikTok has been stealing its creators. See what's going on here?

This vicious cycle is a good reminder that creators are the hot commodity these days. The platforms know it, and much like last year's streaming wars, I have a feeling we'll see platforms fighting over creators in 2022.

If you're a creator, now's a great time to double down and do more. That's my goal, so if you haven't already, please check out my YouTube channel.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Was Bumble's Big Price Squeeze Worth It?

Bumble has been one of the highest earning apps in the US for a very long. While it isn't earning as much as swipe-master Tinder, it's the only one that gets close.

Not only that, thanks to lockdowns and a world that quickly became digital, Bumble's revenue was growing pretty nicely in the last couple of years. But Bumble wanted more and had a "simple" to earn it – By increasing prices and offering fewer features for free.

Did it work?

I don't think so.

Bumble's revenue was growing steadily. According to our estimates, net revenue in the US rose 33%, from $12 million in January to $16 million in December.

In August of 2021, Bumble increased its monthly price from $32.99 to $39.99. I don't know the economics of Bumble, but to me, both of those look pretty high. The increase, along with the steady growth overall, helped Bumble's monthly net revenue to hit a new high in October with $27 million of net revenue in October, according to our estimates.

But this wasn't a trend... In November, revenue decreased, and in December, it increased but not by much.

But the story isn't over. In December, Bumble took away free features and required a paid subscription, which angered a lot of users who took to the App Store and Google Play to leave a negative review.

Back to why this matters - Although revenue grew in January, I think it grew "despite" Bumble's squeeze and not thanks to it. Why? because it declined right after and has only slowly increased since.

If you look at the trend back in the early part of 2021, it's pretty obvious that trend was hindered by something.

Price experiments are always challenging but have a massive upside when done right. Higher prices and fewer features just isn't right. If you're considering changing the price of your app or game, make sure you don't do that.

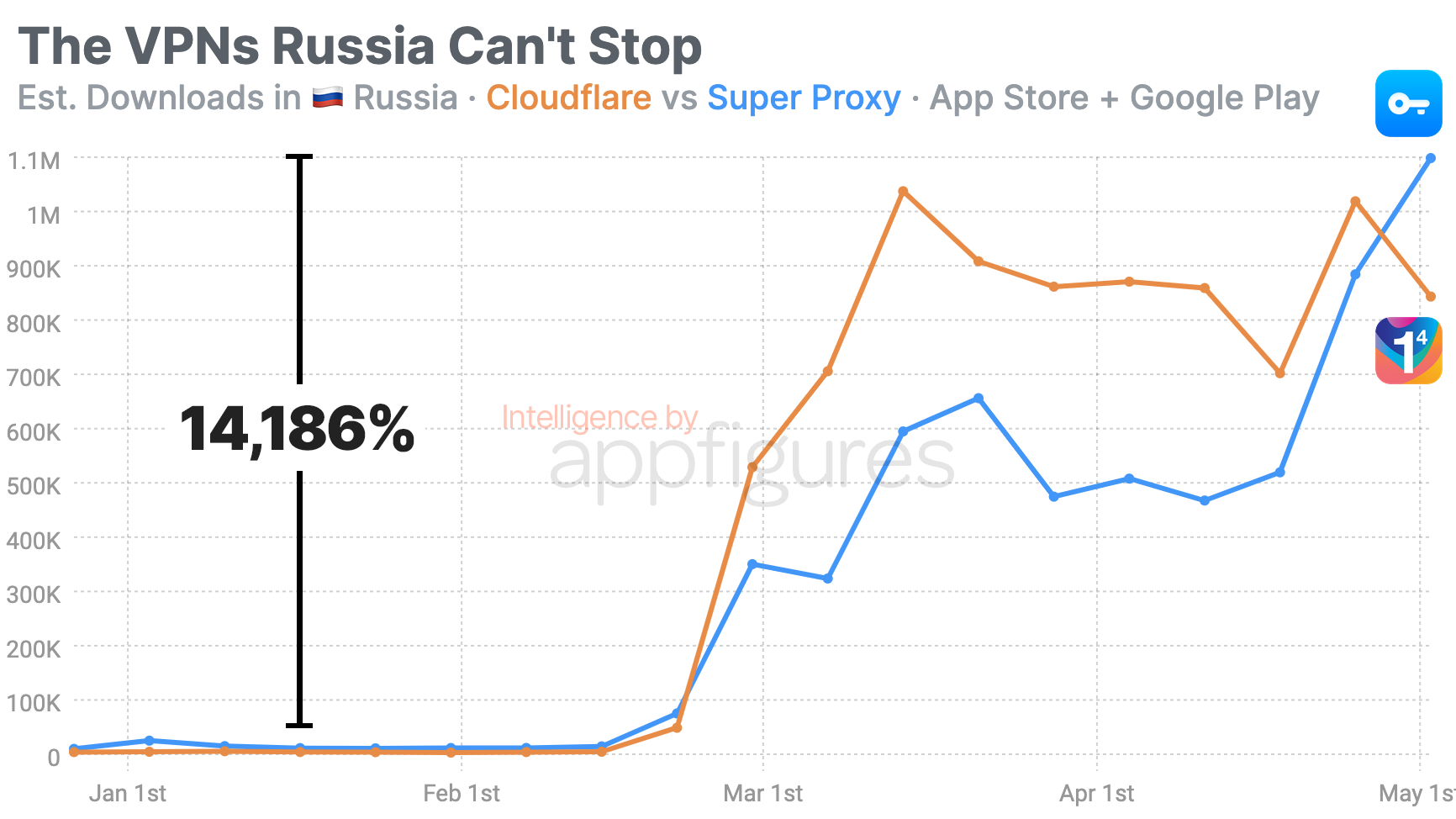

5. The VPNs that (Still) Dominate Russia

Shortly after Russia's invasion of Ukraine began back in February, VPN apps became the most downloaded class of apps in Russia. We covered it a few times early on.

Now, nearly three months into it, I was curious to see if this wave was over.

The short answer is not exactly. VPNs are still some of the most downloaded apps in Russia right now, but the pool of options has gotten much smaller.

Two VPN apps are now in command in Russia, down from more than 10 apps that were fighting for dominance a few months ago. The two are 1.1.1.1, from Cloudflare, a well-known name, and Super Unlimited Proxy, an unknown name.

Downloads of both rose sharply at the end of February. Within two weeks of Russia's invasion, weekly downloads rose from around 14,000 to nearly a million for the pair, according to our estimates.

This was pretty much the case for most apps that had the term "VPN" in their name. But unlike the rest, Cloudflare and its no-name competitor didn't decline. In fact, downloads continued to rise.

Our estimates show weekly downloads have hit their highest last week, adding 1.9 million new downloads from the App Store and Google Play in Russia alone. The previous peak was the week before, but the one before that was back in mid-March.

The demand for VPNs isn't likely to decline as long as there's censorship, and I'm not seeing that ending any time soon. I'm still surprised that these two apps are allowed to operate in Russia. Do you think that'll change?

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.