This Week in Apps - Let's Check In!

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

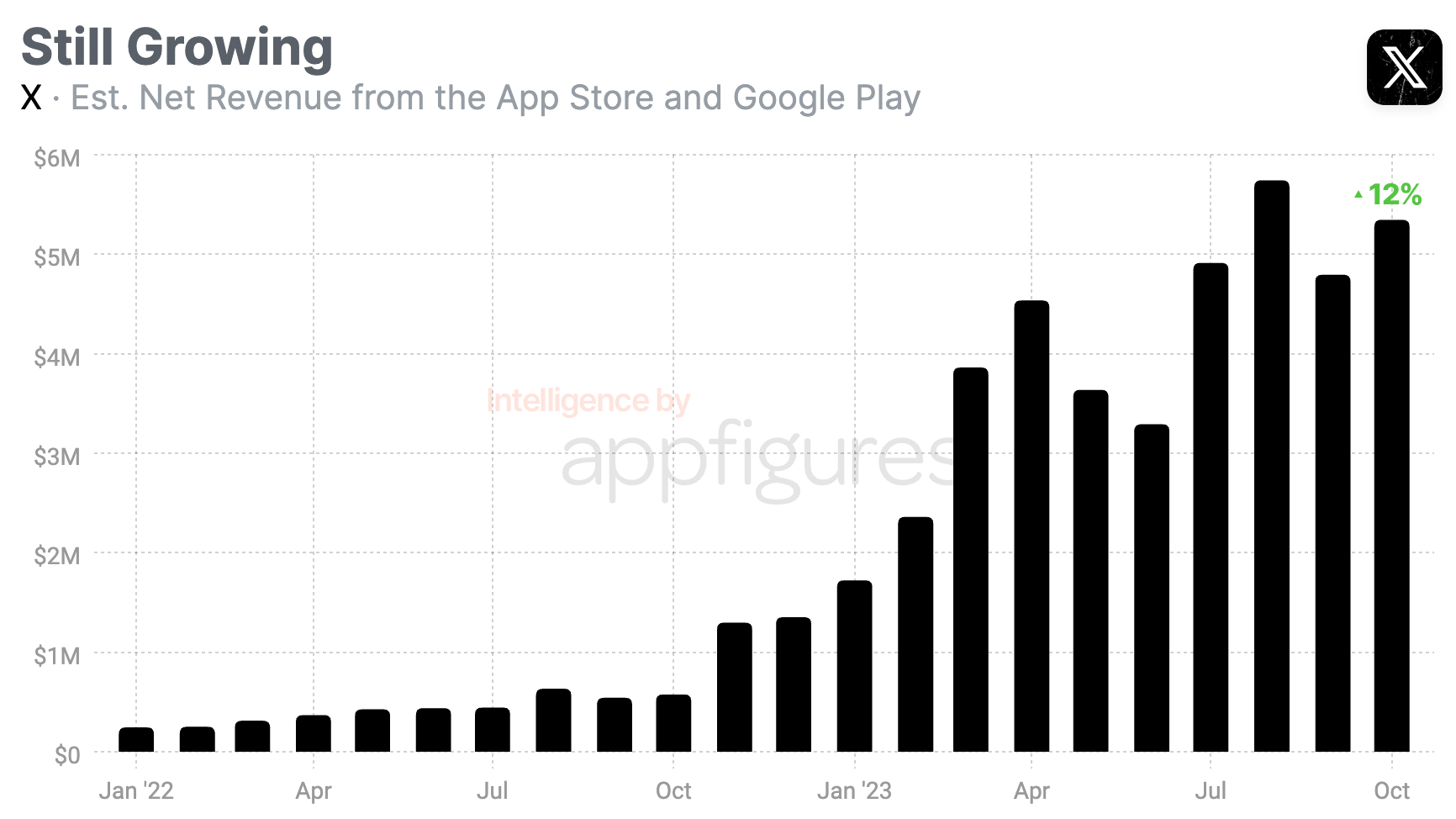

1. X's (aka. Twitter's) Mobile Revenue Grew 829% Since Elon's Takeover

October is behind us, which means it's time to check in on X's (aka. Twitter's) mobile revenue, a monthly series I started when Twitter started monetizing its users back in 2021. As the first social platform to do that, it was interesting to see how it'll grow, and now that Elon's at the helm, it's interesting to see how it's changing.

Unlike September, October was a positive month for Twitter. But...

According to our estimates, X earned $5.4M of net revenue in October from the App Store and Google Play. Compared to last October, before Elon took over, that's an increase of 829%! And that's all net, which means what X gets to keep after Apple and Google take their fees.

If you've been following the series, that's an increase over September's revenue, which was a bunch lower than August. So that's good!

But while October did beat September, it didn't beat August, and I find that potential problematic.

It's interesting because it could mean that subscriptions aren't as popular as many have expected that'd become.

See, before the summer, the only way to earn money on X was from subscriptions. That changed when X started paying creators by the number of impressions their posts got.

If those payments outweigh the revenue from subscriptions, there's less incentive to put effort into subscriber-only content and more incentive to go viral.

It's not necessarily bad for X, but it is interesting.

At the end of October, X introduced two new price tiers. One that's slightly cheaper (Basic) and offers functionality already offered in X Premium but not the blue check, and another that's slightly more expensive (Premium+) that gets rid of all ads.

I expect to see revenue rise thanks to Premium+ in November.

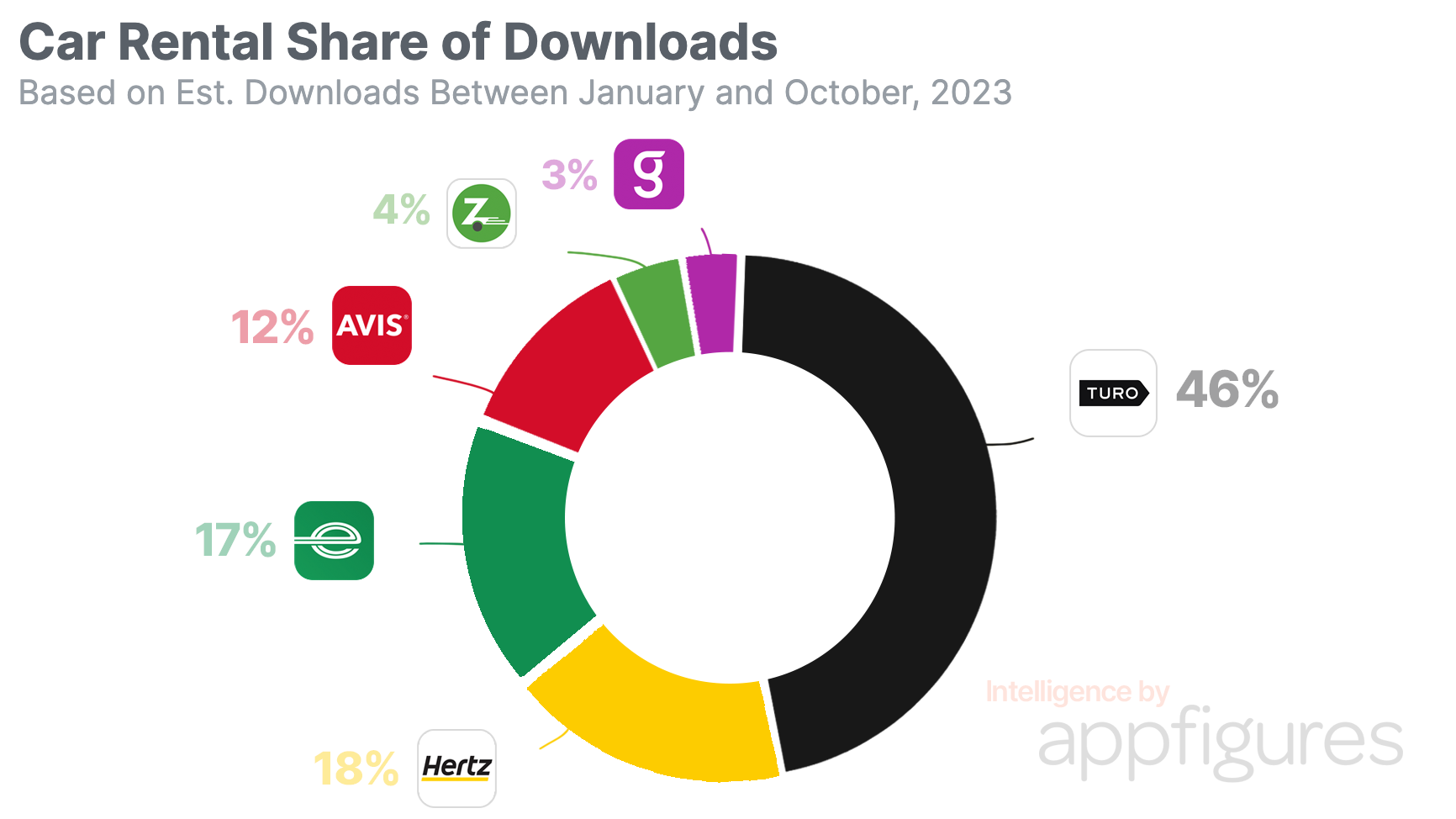

2. Non-Traditional Car Rentals Continue to Dominate Growth

A few summers ago I looked at the car rental market on mobile to see who's the go-to. As a user of most of those apps (before buying a car) I wanted to see how non-traditional rentals are performing, and it turned out Turo, a non-traditional renting app where you can rent other people's luxury cars for relatively cheap, was the winner.

And the numbers were big. So big Turo actually used the data from that article when going public!

It's been two years since that article - are things still the same?

Yes! Well, almost!

Two years later, Turo is still the most downloaded car rental app in the US, beating both traditional and non-traditional competitors.

Looking at downloads between January and October of 2023, Turo had 46% of the downloads across the top 6 competing renters, which include 4 traditional and 2 other non-traditional renters.

Compared to the last analysis, Turo's share of downloads has dropped a bit - from 47% to 46%, but the downloads haven't. In fact, Turo's monthly downloads rose from an average of 275K in 2021 to more than 500K in 2023.

According to our App Intelligence, Turo welcomed 4.9M new downloads from the App Store and Google Play in the US between January and October of 2023. By far its biggest year of downloads.

But what about the rest? In the last analysis, Enterprise was the second largest competitor to Turo in the US with Hertz and Avis within a clear margin away. That's now changed.

In the US, Enterprise has lost its second place, and instead, it's Hertz that's claiming it.

According to our estimates, Hertz saw 1.9M new downloads from the US App Store + Google Play between January and October of 2023, while Enterprise saw 1.8M. That might feel like a small difference, but it means 18% and 17% share of downloads, respectively, vs. 11% and 18% in the last analysis.

So Hertz figured something out and it's working well!

On the other end, non-traditional renters Zipcar and Getaround, which were already low in the last analysis with 8% and 7% share of downloads, respectively, are now even lower.

Zipcar, the company that created the whole instant car rental category aaaaall the way back in 2000, saw just 4% of downloads while chief rival GetAround saw 3% of the downloads this year.

They still exist, so that's something, but they're just not growing.

The thing is, demand for all other competitors has grown in the last few years. All but Zipcar and Getaround. Their downloads have been very stagnant.

Having used Getaround before, I'm not very surprised, but Zipcar's inability to grow does strike me as an unforced error. Being owned by Avis, which isn't doing all that well in the traditional space, is probably related.

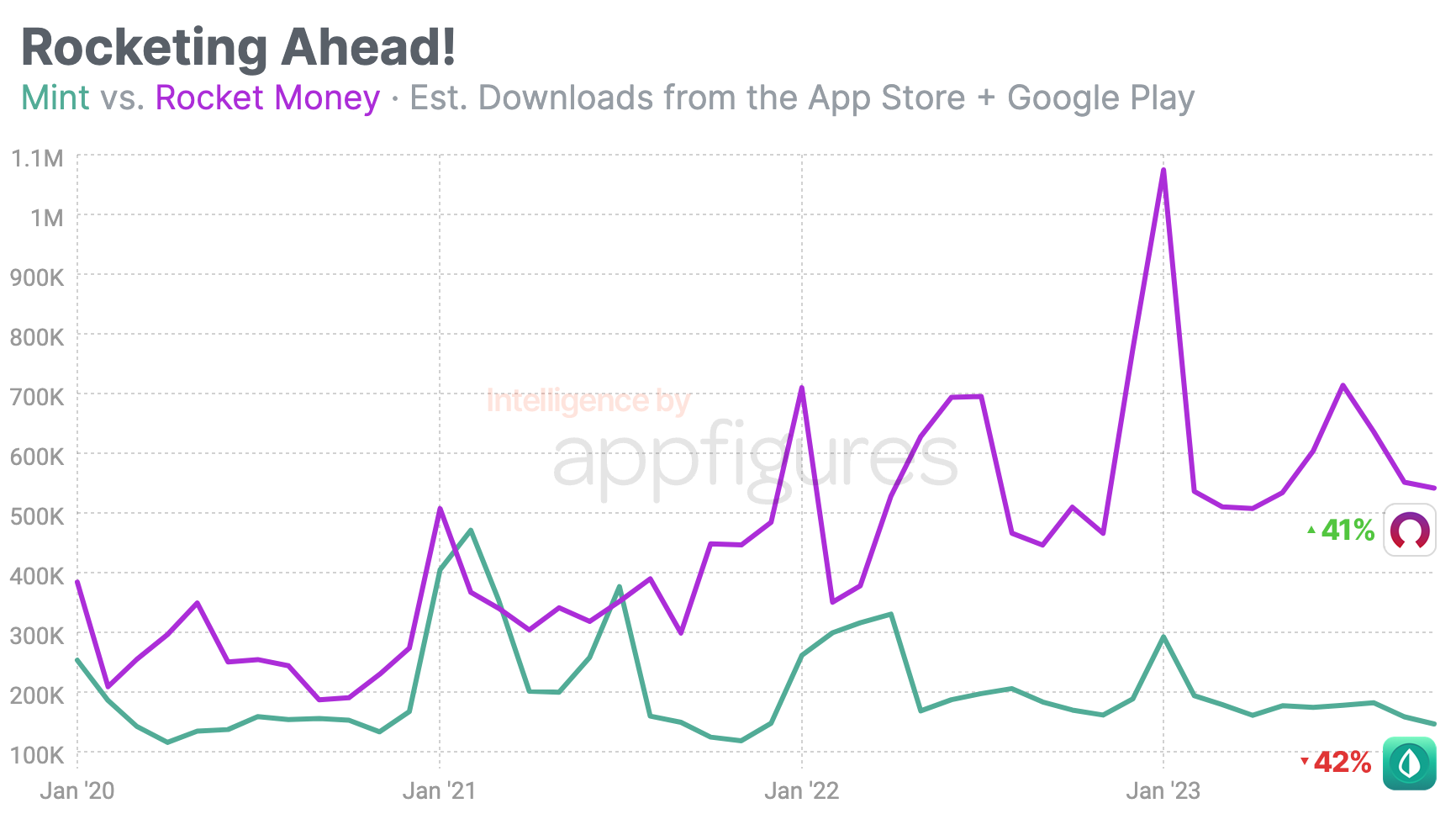

3. Why is Intuit Killing Mint, a Crowd Favorite?

Back in 2009, finance app conglomerate Intuit acquired Mint, a budget tracker that was very successful on the web and started to grow on the then brand-new iPhone.

As a user of Mint back in the day, I remember it was pretty revolutionary. It automated pulling all of your purchases and transactions from banks and credit cards and classified them for you so you can easily see where your money is going without needing a bookkeeper.

Now this is pretty standard but back then it wasn't. Mint kickstarted personal budgeting.

When Intuit bought Mint I knew its days were numbered, but to my surprise, Intuit didn't kill Mint right away. It took many of its features and brought them into its other consumer products TurboTax and Quicken, but the app was still alive.

Well, the time for Mint has come... 14 years later.

I looked at the trends and it's pretty clear why it finally happened.

Looking at Mint's downloads and comparing them with the competition, the first thing to note is that Mint isn't the most downloaded budgeting app out there, which is what I'd expect considering Intuit's size.

The most downloaded budgeting app is Rocket Money, which saw 2.4x more downloads than Mint this year. In more absolute terms, our estimates show Mint got 1.9M downloads between January and October while Rocket Money saw 4.6M downloads.

And if we zoom in on October, the gap rose to 3.6x.

In fact, since January of 2020, Mint's monthly downloads have dropped by a scary 42%. And guess what, Rocket Money's monthly downloads rose a whopping 41% at the same time.

So, Intuit is losing the downloads (aka growth) race.

But that's not all. Downloads are good, but revenue is better.

So far in 2023, Mint earned a total of $1.6M of net revenue, which nets out to $0.86 per user. And this is all net, so it's what Intuit gets to keep after Apple and Google take their fees. And it's worth noting that the majority of this revenue, a little over 96%, is coming from the App Store. Google Play accounted for just 3.8%.

Rocket Money plays at a different level. Our estimates show Rocket Money earning $8.7M, which nets out to $1.40 per user. And again, this is net, so we don't have to worry about Apple/Google fees here.

So, Intuit is losing the monetization race.

There is some good news here. Mint's monthly mobile revenue grew 26% since the beginning of the year while Rockey money's dropped a bit. Obviously though, not a good enough reason to keep pushing.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

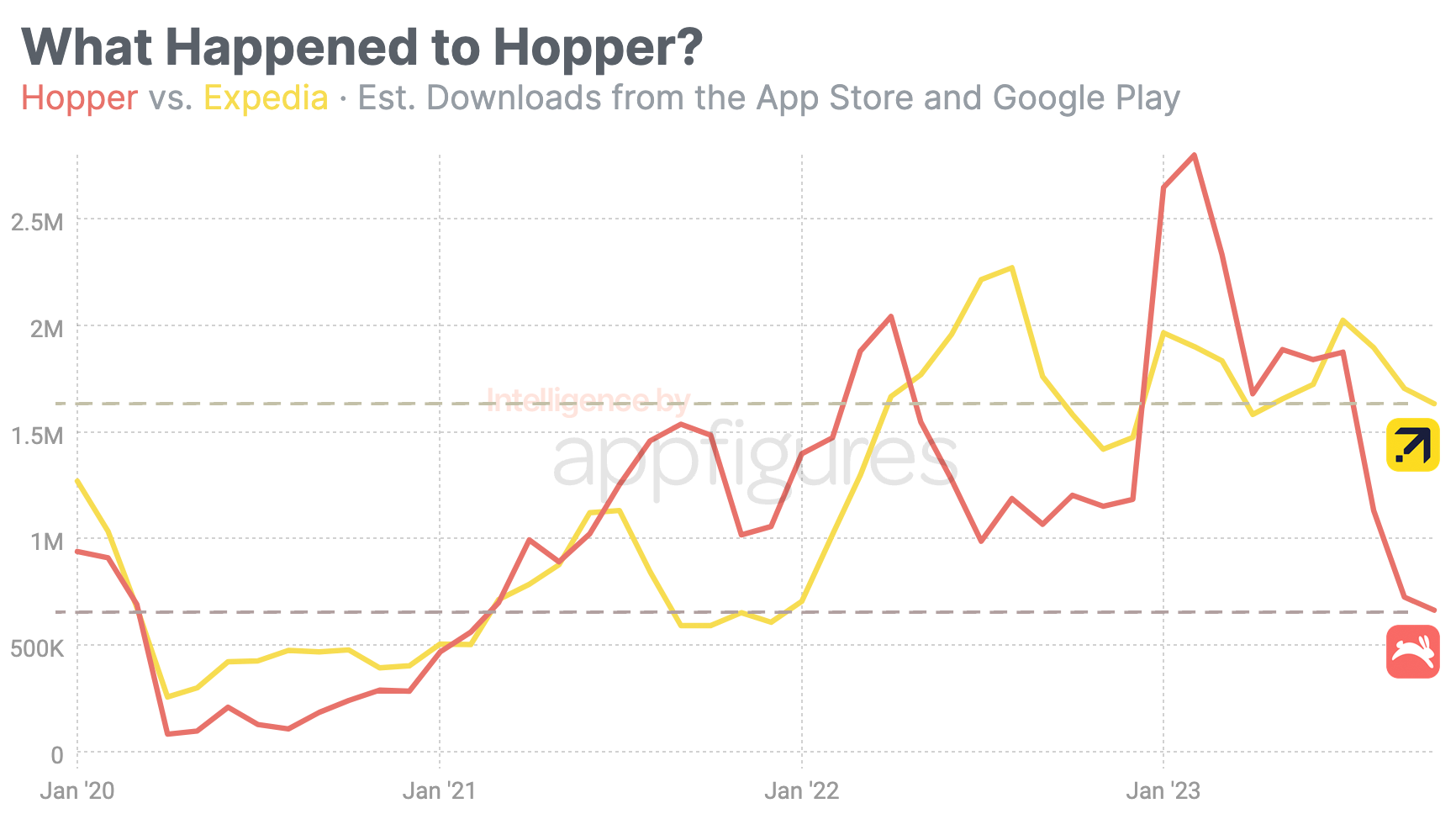

4. Hopper Goes from Leader to Loser in Travel Booking Race

Hotel booking, when it came to apps, was a game Expedia won. But then the pandemic happened, erasing demand substantially. Yet, Expedia was still the winner - but not for long.

Hopper, which was founded in 2007 but didn't launch until 2015, was fairly popular pre-pandemic for its ability to find the best time to book travel. It was always trailing in downloads behind Expedia, but...

In January of 2020, Hopper saw 939K downloads from the App Store and Google Play according to our estimates. Expedia saw 1.3M.

Lockdowns hit both hard. According to our App Intelligence, Expedia dropped to just 257K downloads in April and Hopper to 83K. Brutal!

Both started recovering fairly quickly, and by the end of 2020, Expedia managed to climb back to 403K downloads with Hopper behind it with 284K.

By February the tide had turned.

Growing demand for travel + Hopper's ability to find cheaper travel gave it a leg up, and the downloads are the proof. Hopper had been outperforming Expedia every month in 2021!

By December, Hopper was getting nearly 2 downloads for every download Expedia was getting. In more absolute terms, Expedia's 607K downloads were outmatched by Hopper's 1.1M.

In total, Hopper managed to raise $729.7M across 12 funding rounds. Wow!

Fast forward to 2023, and after 17.6M downloads - 1.2M downloads more than all of 2022 -- and Hopper just clocked in its lowest month of downloads since it started outpacing Expedia. Now you know what this whole build-up was for.

After a massive opening to 2023, Hopper's downloads started dropping in July - giving Expedia its first month of more downloads this year.

Downloads went from a peak of 2.8M in February to just 664K in October, according to our estimates.

That's lower than January of 2020. It's also lower than two hotel chains that have seen their app downloads more than double since 2020!

Hilton & Marriott Double

Marriott and Hilton, two chains that have their own apps, have also been working to grow their downloads.

Hilton and Marriott started 2020 with 261K and 300K downloads, respectively. Hotels weren't really pushing their own apps back in 2020 and rather relied on services like Expedia and Hopper for booking.

But that changed during covid, and both started pushing their apps as the better way to book. And it's working!

By January of 2022, Hilton's app grew to 291K downloads and Marriott's to 461K. Marriott has been very aggressive about pushing its app with ads in a variety of places. And it's working!

This January, downloads are up even more, to 520K and 710K, respectively. Although that hasn't really stopped Expedia or Hopper, both are growing alongside each other.

As of October, the pair clocked in the most downloads ever! 706K and 789K downloads, respectively, according to our estimates.

I fully expect to see more enterprises pushing their own apps instead of relying on third parties. I'll look at airlines in the future.

5. Peacock's Big Win with Five Nights at Freddy's

A movie based on a game hit theaters and started streaming last week. Over the years, a few games have gone to theaters, but it doesn't happen too too often so it's interesting to see the impact on downloads and revenue.

Five Nights at Freddy's is a franchise of paid games that's been around since 2014. Last week, the movie rolled out for Halloween and was well received by viewers - both moviegoers and streamers.

As of yesterday, the movie has crossed $100M from theaters, and that's while the movie was also streaming on NBC's Peacock. It was the second-fastest type of dynamic release to do so after Marvel Studios’ Black Widow back in 2021.

Did more people download Peacock thanks to the movie?

Absolutely!

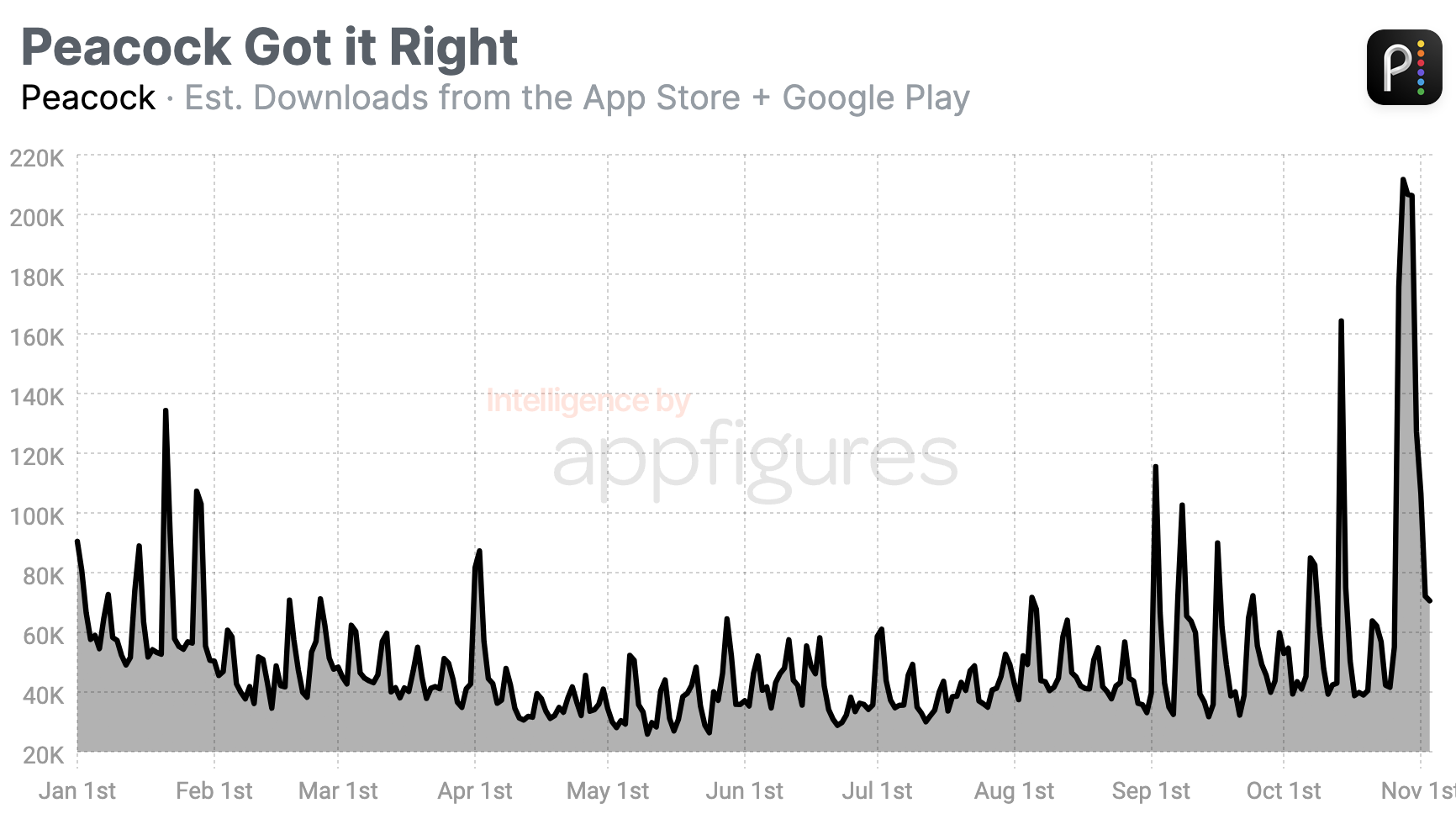

Thanks to Five Nights at Freddy's, October was the highest month of downloads this year for Peacock, clocking in at 2.4M, according to our estimates. The previous peak was January which had 2.1M downloads.

The movie also gave Peacock the most daily downloads this year - 211K last Sunday. The previous high came earlier on October at 164K.

According to our App Intelligence, Peacock saw more than a million downloads between Friday and Wednesday. More than half what it normally sees in the same range.

Did more people buy the mobile games thanks to the movie?

Of course!

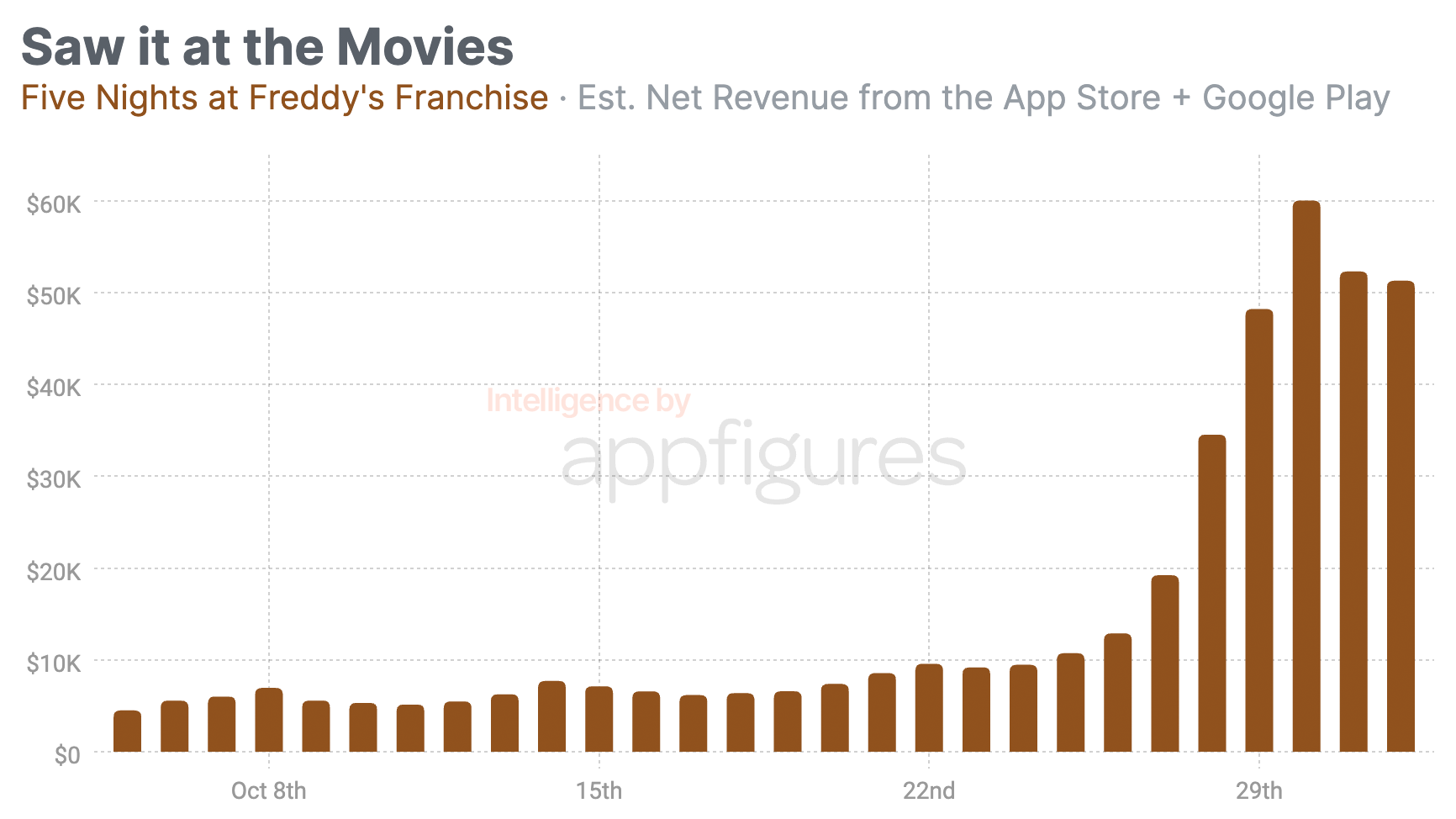

I aggregated all of the franchise's titles across the App Store and Google Play, which consists of Friday at Freddy's 1-4 as well as the SL and AR versions, so we can see the impact of the game on revenue.

The set earned about $5K from the App Store and Google Play on an average day earlier in October, according to our estimates. And it's important to note that these are paid games, and those earn much less than their free with in-app purchases competitors, so curb your expectations.

Revenue started rising on release day and peaked on Monday with $60K of net revenue, which is what the publisher keeps after Apple and Google take their fees.

Revenue dropped a bit after Monday but remained at more than 10x the average.

Between Friday and Wednesday, the collection earned $266K of net revenue from the App Store and Google Play, according to our estimates. That's roughly 8x what it would earn in the same number of days earlier in October.

At a time when the bigger streamers seemingly "forgot" content is king, NBC is doing it right, and it shows with the growth of Peacock.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.