When CapCut launched a standalone video editor app it was clear it'd rise to the top and dethrone incumbents that have enjoyed dominance in the rather focused niche earning millions of dollars for over a decade.

A free app competing with freemium/subscription apps is no challenge, but now that CapCut started charging we can quantify its success and the success it's taking away from its competition - in dollars.

To give context to CapCut's revenue growth I'm going to compare it to one of the longest-running incumbents in the space - Facetune, which also happens to be the highest-earning competitor in the US.

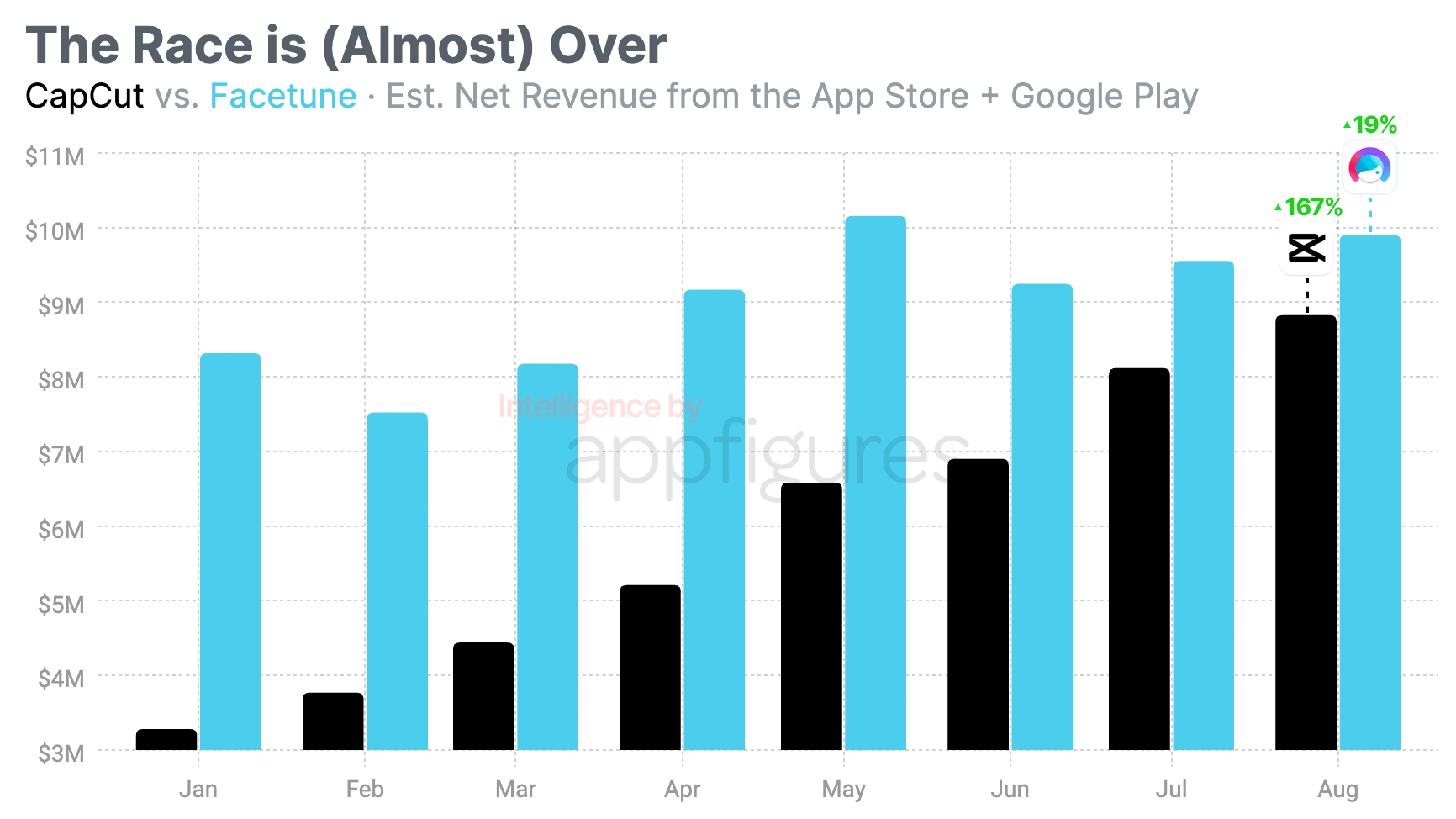

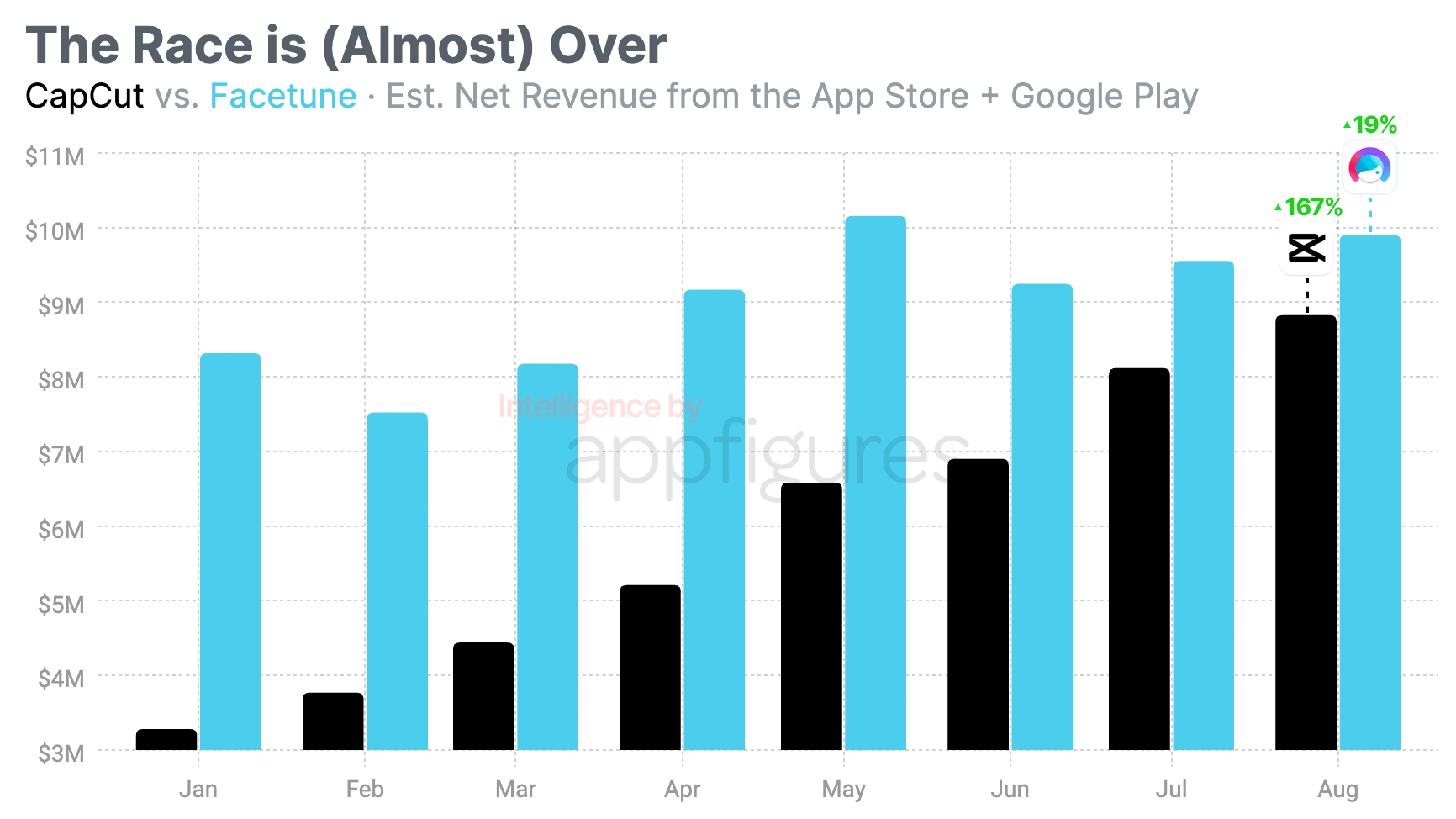

CapCut kicked off 2023 with 3.3M of net revenue from the App Store and Google Play in January, according to our estimates. Facetune saw $8.3M of net revenue in January. Quite a big lead.

By May, CapCut was already at $6.6M! Facetune also saw some growth, earning $10.2M - and that's all net which means what the publishers get to keep after giving Apple and Google their share.

May was Facetune's highest month of revenue this year. In August, Facetune earned $9.9M while CapCut's revenue grew a whopping 33% from May giving CapCut $8.8M in net revenue, according to our estimates.

That big lead from January is now almost all gone. At this growth rate, CapCut will outpace Facetune within a month.

Since January, CapCut's revenue grew 166%. I don't see any reason for it to end, and that's a big problem for the incumbents. The kind that's fought and won with innovation and big ad campaigns.

The most downloaded app in the US App Store right now is a coloring book that hasn't been updated in 7 years. And it loo...

An app catapulted to the top of the App Store last week and then disappeared abruptly. Fast risers aren't new, but abrup...