This Week in Apps - Let's Go Viral

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Downloads Index (vs. 30 days ago)

Insights

1. By the Numbers: Analyzing App Downloads in the App Store and Google Play

How many apps get a thousand downloads a month? How about 100, or a million? That's the kind of question I get asked very often and the results always surprise people.

To answer this question more conclusively, I analyzed all of the apps in the App Store and on Google Play using our download estimates. We recently expanded our country coverage, so we have even better visibility into downloads.

FYI - This is a follow-up to the Monthly Millionaire Club I covered a couple of weeks ago.

I grouped apps by their downloads and looked at all apps with more than 100 downloads in the last month and all the way up to the 10M+.

I'm sure you can guess which group has the most apps (and games), but you can guess how big it is?

Most apps in my analysis, 47.7% to be precise, got between 100 and 1K downloads globally in the last month. How close was your guess?

33.3% of all the apps I looked at got between 1K and 10K downloads in the last 30 days across the App Store and Google Play.

Add those two up and you'll see that 80% of apps and games get under 10K downloads every month, which averages around 300 downloads a day on the high end. And that's 80% of apps with more than 100 downloads per month, so it doesn't include most of the App Store and even less of Google Play.

The next group is the only other group with a double-digit percentage, and that's the 10K - 100K group. This is also where we start to see more investment in paid ads and Apple Search Ads.

Only a handful of apps, 3.8% of the apps in the analysis, saw between 100K and 1M downloads in the last 30 days. More apps in this category come from Google Play vs. the App Store.

And maybe I used the term "handful" too soon because when we zoom in on apps with between 1M and 10M downloads, the number shrinks to just 0.5%. Most household names, like Twitter and the App Store versions of TikTok and Instagram, fall into this group.

The last group is the tiniest of them all - so small it only has 21 apps in total in it. That's the 10M+ group. 20 of those come from Google Play and 1 from the App Store. Just 1.

If you read the Monthly Millionaire's Club article you might find this a bit surprising, but that was revenue and this is downloads. Google Play attracts many more downloads overall.

2. This Latest TikTok Success Story Grew Revenue 5x in a Week

Threads, Instagram's Twitter clone became the #1 app in the App Store on launch and seemed like it would be there for a long time. But it didn't.

Remini, an AI photo app that's going viral right now, skipped to the top of the chart, pushing Threads down.

Its timing was just perfect!

Remini dethroned Threads as the #1 app in the US App Store on Monday evening, just as the crazy demand for Threads subsided, and has been holding the position ever since.

We've seen apps go viral and rise to the top before, which is nice, but not all were seeing an increase in revenue as the downloads streamed in. So instead of looking at downloads I looked at revenue.

Remini's ascent to the top took a little over a week, and in that week not only did downloads grow but so did Remini's revenue.

We estimate that Remini's daily net revenue rose from about $90K to $567K -- in one day -- on Wednesday.

If you're asking what's worth a half million dollars a day the answer is a new AI filter that can turn an adult picture into a baby. Remini went viral on TikTok and between last week and this Wednesday it earned a total of $2.3M of net revenue. And that's net which means what Bending Spoons, Remini's publisher, gets to keep after Apple took its share.

Sounds like luck but it's more than that. Going viral might be luck but turning downloads into revenue at such a scale isn't. That takes a lot of effort.

If you've got an app or game out there, you should be laser-focused on turning every download into a paying customer. This way, when luck hits and you go viral, you'll get the absolute most out of it.

Oh, and Remini definitely helps itself by using Apple Search Ads to push the app while it's viral. According to our Apple Search Ads Intelligence, Remini pays for nearly 300 keywords. Many of those are competitor names and the rest are specific use cases.

3. Did Prime Day Help Amazon Get Ahead of Newer Rivals?

Amazon's annual shopping event, Prime Day, took place this week and ushered 48 hours of exclusive deals and discounts across the store.

As shopping moves to mobile, Prime Day serves as more than just a way to get more sales from existing users but rather a way to get new users into the platform. And more importantly, away from rivals.

As such, downloads of Amazon's app serve as a good proxy for the success of the second goal.

I looked at the downloads of Amazon this week and compared them to rival SHEIN in the US.

On Prime Day, which started on Tuesday (7/11), Amazon's downloads rose to 73K, up about 43% from the daily average over the last few months. That's across both the App Store and Google Play, according to our estimates.

It was enough to get close, but not beat rival SHEIN, who saw 74K downloads on the same day.

Amazon has dropped behind rival SHEIN and even more so behind new(ish) Chinese rival Temu, this year.

And when you put the trends side-by-side you can see the downloads have shifted from Amazon to those rivals who offer lower prices, fast (enough) shipping, and advertise heavily.

Prime Day used to be a massive event, both in terms of deals and downloads, but both trends subsided in recent years.

It's easy to say "Everyone has Amazon already", but that's unlikely to be true and even if it is, not everyone is using Prime, which is what Amazon really wants as a way to lock in the buyer. For that, Amazon has to continue pushing ads, something Temu and SHEIN do heavily.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. Is Anyone Still Reading Real Books?

A few weeks ago, I looked at the amazing revenue growth of Audible, Amazon's audiobook arm. The app earned $33M of net revenue from the App Store in May, up 1,500% since 2020.

My theory was that more people want to read books but instead are going with the more convenient audio version. I personally don't find audiobooks a replacement for physical books, but I'm obviously in the minority here.

Well, Audible is not the only sign there's more demand for books and less demand for reading all at the same time.

Headway, an app that offers book summaries, has hit a new peak of downloads in June.

According to our App Intelligence, downloads of Headway have been rising consistently over the years, starting at 150K in January of 2020 and ending with 1.4M in June of 2023. That's across the App Store and Google Play, and the distribution is fairly even across the two.

On the App Store, those downloads resulted in $44M of net revenue. That's what Headway gets to keep after Apple takes its share.

There isn't that much competition in this space but with such growth from Headway and Audible I expect to see more apps and platforms trying to take a share of that revenue and that growth.

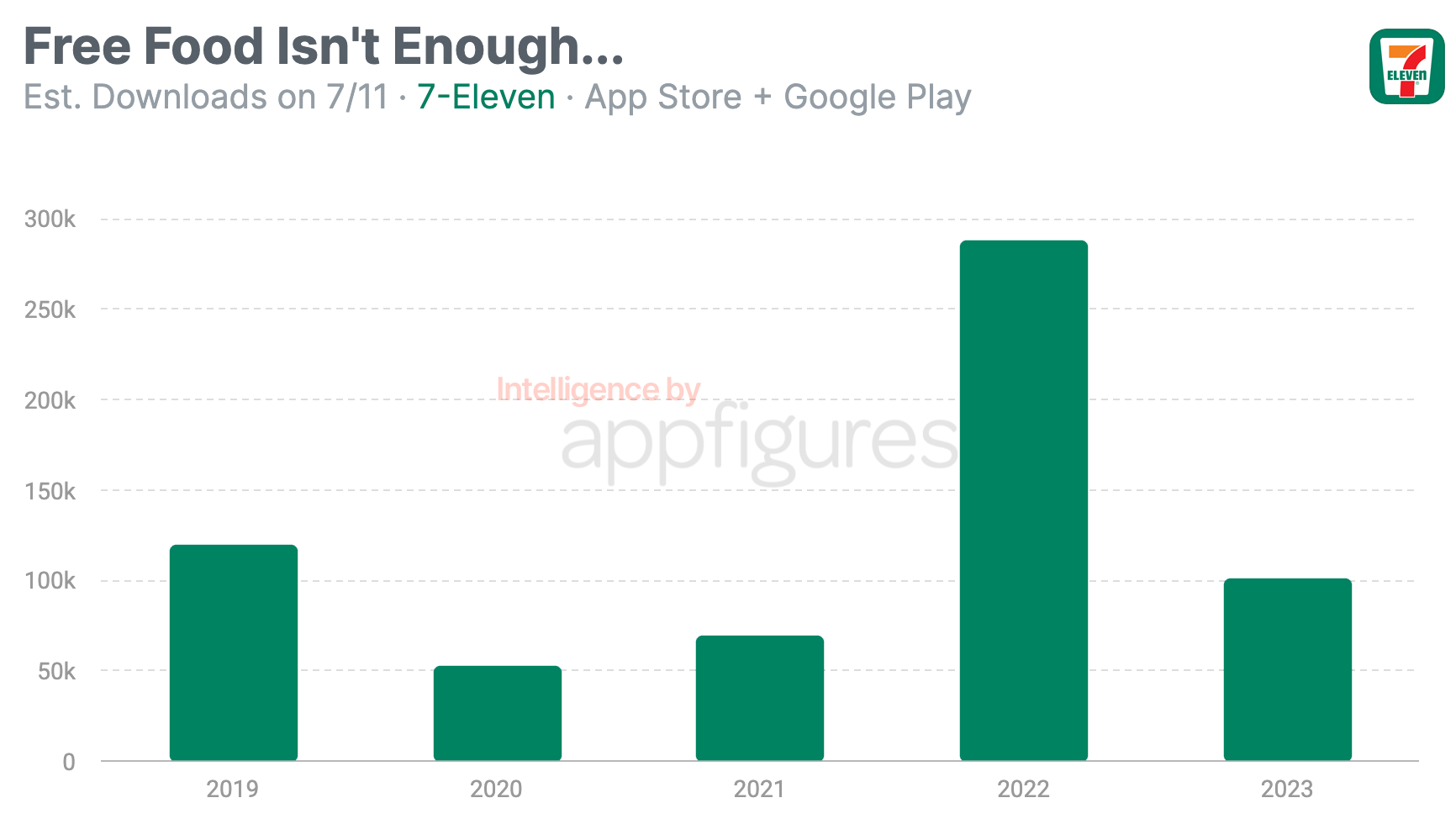

5. 7-Eleven's Free Slurpee Day Wasn't a Big Hit...

7-Eleven has been giving away free Slurpees, the company's flagship drink, on July 11th for more than 20 years. In 2019 the chain started requiring downloading its app to get the drink, giving us visibility into how popular the campaign is.

In 2022, free Slurpees were very popular!

The first time 7-Eleven ran this campaign tied to its app, back in 2019, the company managed to get 120K new downloads. At the time, this was 7-Eleven's biggest day of downloads ever! Roughly 12x more than a normal day.

Covid came in 2020 and made visiting a store more difficult. The campaign's second year added just 53K new downloads from the App Store and Google Play, according to our estimates. At the time, that was a 7x increase over the daily average and about 11x more than covid time.

2021 was very similar to 2020 but with 70K downloads. A bit higher but not by much.

2022 set a record! Downloads rose to 288K on 7/11, 2,780% higher than the daily average, and 7-Eleven's most successful campaign!

And now let's talk about 2023, which wasn't stellar.

Downloads rose 10x this Tuesday, the 11th, to 101K, and even though it isn't the lowest, considering 2020 and 2021 didn't see many people out and about, I'd say this number is the lowest to date.

Do people no longer care about Slurpees? Does everyone have the 7-Eleven app already? I don't think so x2.

It's all about promotion, and this year I didn't really see much of this campaign. It may seem like giving away free stuff will always bring in all the new users but that's obviously not enough anymore.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.