This Week in Apps - July Was a Big Month...

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (30 Day)

Insights

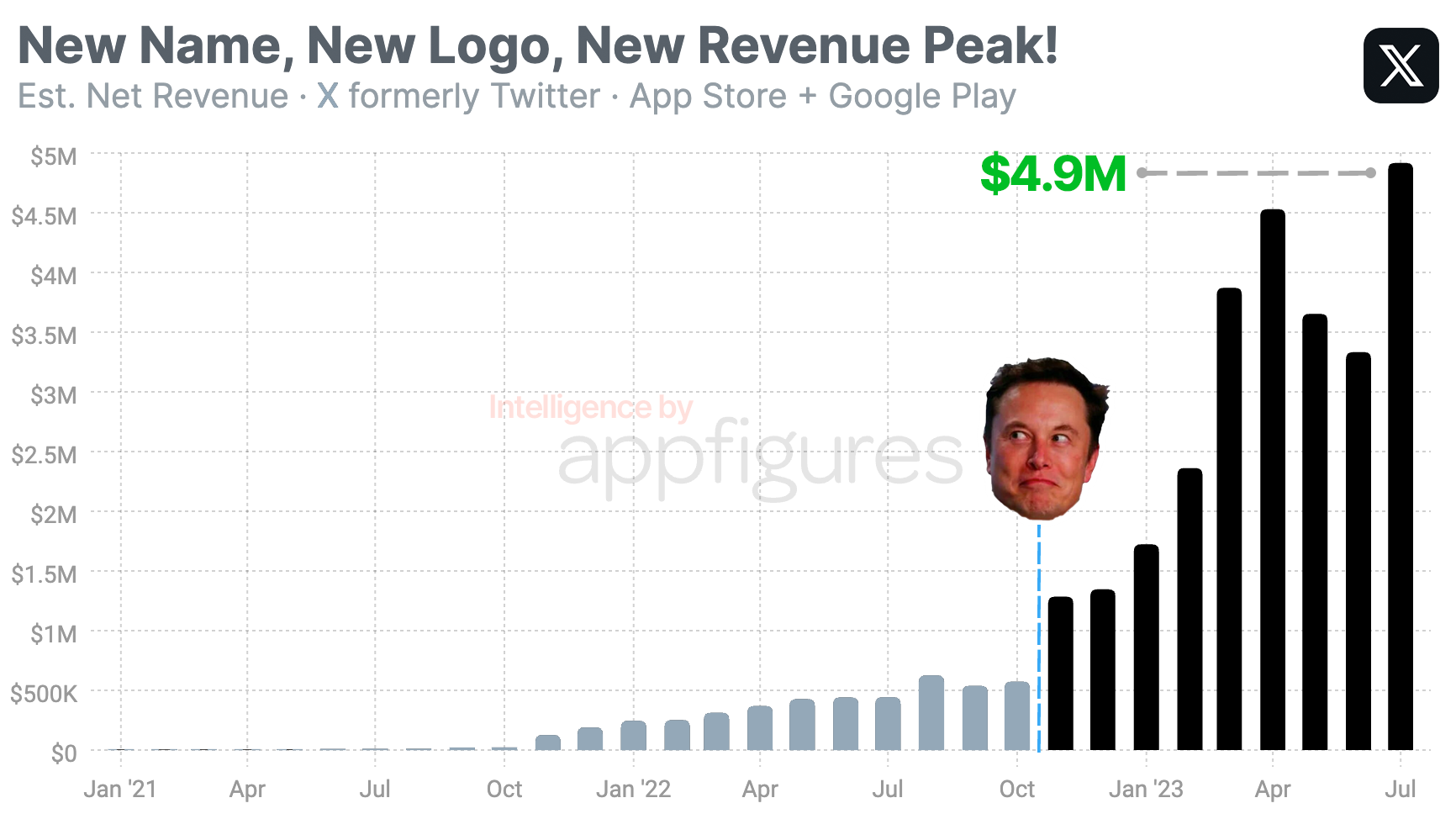

1. July was X's (aka Twitter) Highest Month of Mobile Revenue

Bye bye birdie...

Twitter is now X and I can feel the difference. But that won't stop me from continuing the monthly tradition of checking in on X's revenue.

The last couple of months were not great for X, having seen revenue go down for the first time since Elon took over.

July was different.

Twitter's mobile apps brought in $4.9M of net revenue in July, according to our estimates. That's the combined total from the App Store and Google Play and is what Elon gets to keep after giving Apple and Google their fees.

It's also the app's biggest month of revenue, growing 9% from the app's previous peak back in April.

And also the first month of growth after two months of decline -- back to back.

After growing steadily every month this year and peaking at $4.5M of net revenue in April, Twitter's revenue declined sharply in May and June. Our estimates show May's revenue dropped 20% to $3.6M and in June revenue dropped even lower, to just $3.3M.

Subscriptions are certainly responsible for some of this but I don't think they're growing at the rate Elon and co wanted or expected. That's why he's now sharing ad revenue with popular users.

But the real question isn't whether subscriptions are working but rather, will things be different now that Twitter is no more and it's all X?

We'll see next month.

2. Nord, the King of VPNs, Soars in 2023

VPNs have risen in popularity in the last few years as wars, government censorship, and lots of ads are helping many change their IP.

There are more than 9,000 VPN apps on the App Store and Google Play which we estimate to have earned more than $20M last month according to Explorer. And that's all net revenue, meaning what the developers get to keep after Apple and Google deduct their fees.

The leader of the group is NordVPN, and if you browse the internet you've probably seen or heard an ad for it at some point.

Nord also wrapped up its best quarter of revenue!

Stretching our App Intelligence back to 2018, in Q1, Nord mobile app, which was 4 years old at that point, already earned $950K of net revenue.

By Q1 of 2019, revenue rose to $3.2M, and by 2021, revenue was already at $5.3M.

ExpressVPN, Nord's top competitor, is on a similar path. It launched around the same time as Nord but revenue growth started a bit later. In Q1 of 2021, ExpressVPN earned $3.4M of net revenue, according to our estimates.

Let's talk 2023.

Nord and ExpressVPN have both hit new all-time highs in 2023. ExpressVPN's revenue rose to $9.5M in Q1 and dropped a bit in Q2. Nord's revenue rose to $13.3M in Q1 and to $14M in Q2.

And yes, Nord is spending on Apple Search Ads. In case you were curious.

Nord is running ASA in more than 20 countries and the one where the app shows up most isn't the US but rather the UK. The US isn't second, Australia is, nor third, that's Japan. The US is fifth, right below Japan.

The US is more competitive which means every impression is more expensive, so this data doesn't mean Nord is spending less in the US.

Spending less and getting more visibility is a good optimization for any campaign.

If you have a global user base and only spend on ads in the US, take a minute to find the top 3 countries where you're getting the most revenue per download and expand your ASA campaign to those but with a lower budget.

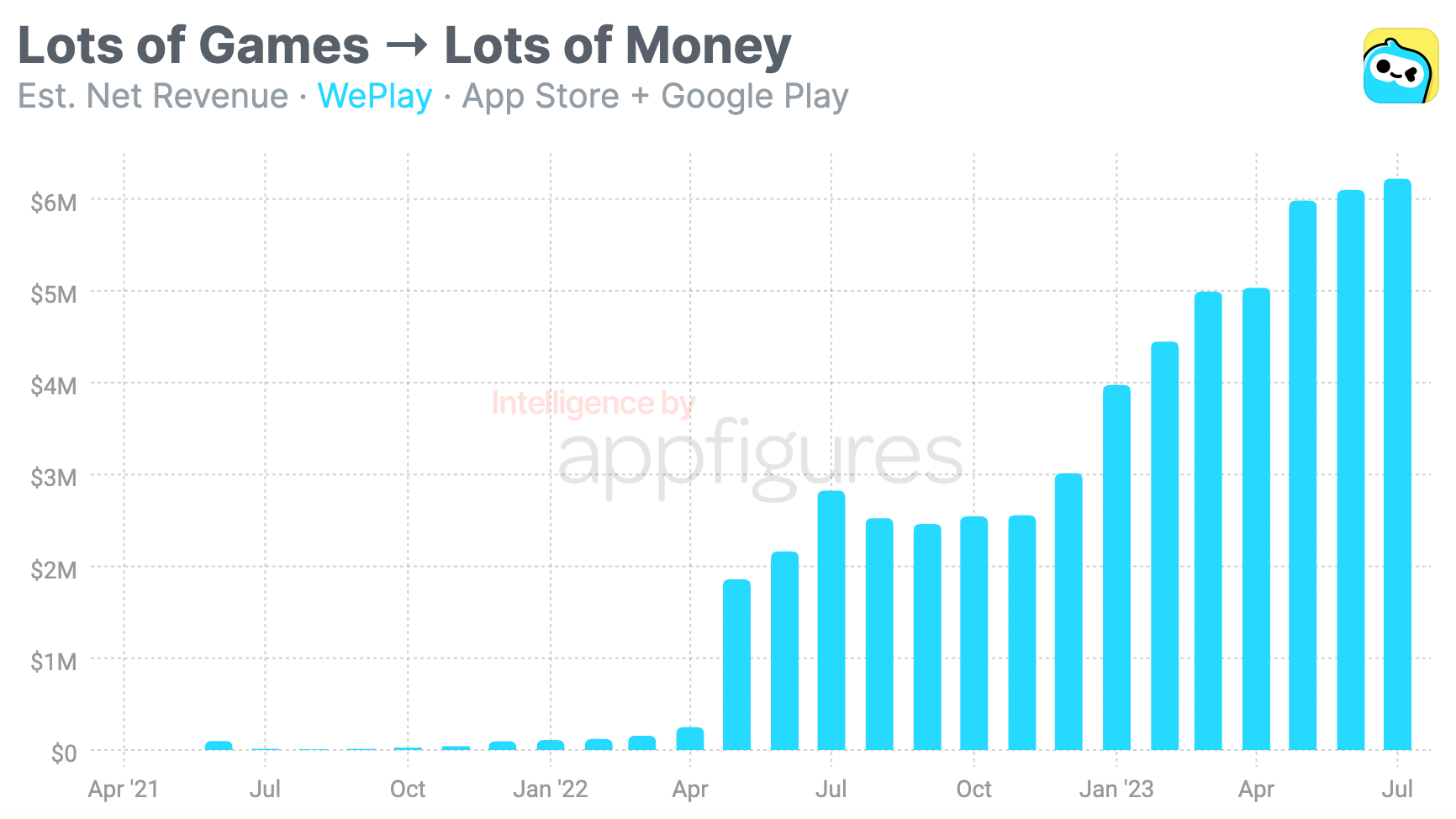

3. WePlay's Revenue Hits a Record High in July

The App Store's Top App & Games chart in the US has seen a lot of activity this summer. This week's main attraction is WePlay, a collection of casual games bundled into a single app.

Last week, WePlay was the 8th most popular app in the US App Store.

WePlay's revenue hit a new all-time high in July, earning the Singapore-based developer $6.2M of net revenue, which is what's left after Apple and Google take their fees.

This revenue comes from both the App Store and Google Play, where there is a separate WePlay app for each region. Five per store.

Over the last two years, WePlay earned a total of $115M of net revenue from all regions, according to our estimates.

What's interesting here is the rate at which revenue has been growing. Over the last two years, monthly revenue grew from hundreds of thousands to millions very quickly and then doubled in about a year.

I looked at the revenue by country and was a little surprised the US wasn't WePlay's top earner. Taiwan was the highest earner for WePlay over the last two years, hauling $19M. Japan followed with $11M and the US was third with $6M.

There's a lot of catching up to do, and I expect to see WePlay chart high for at least a few more weeks.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

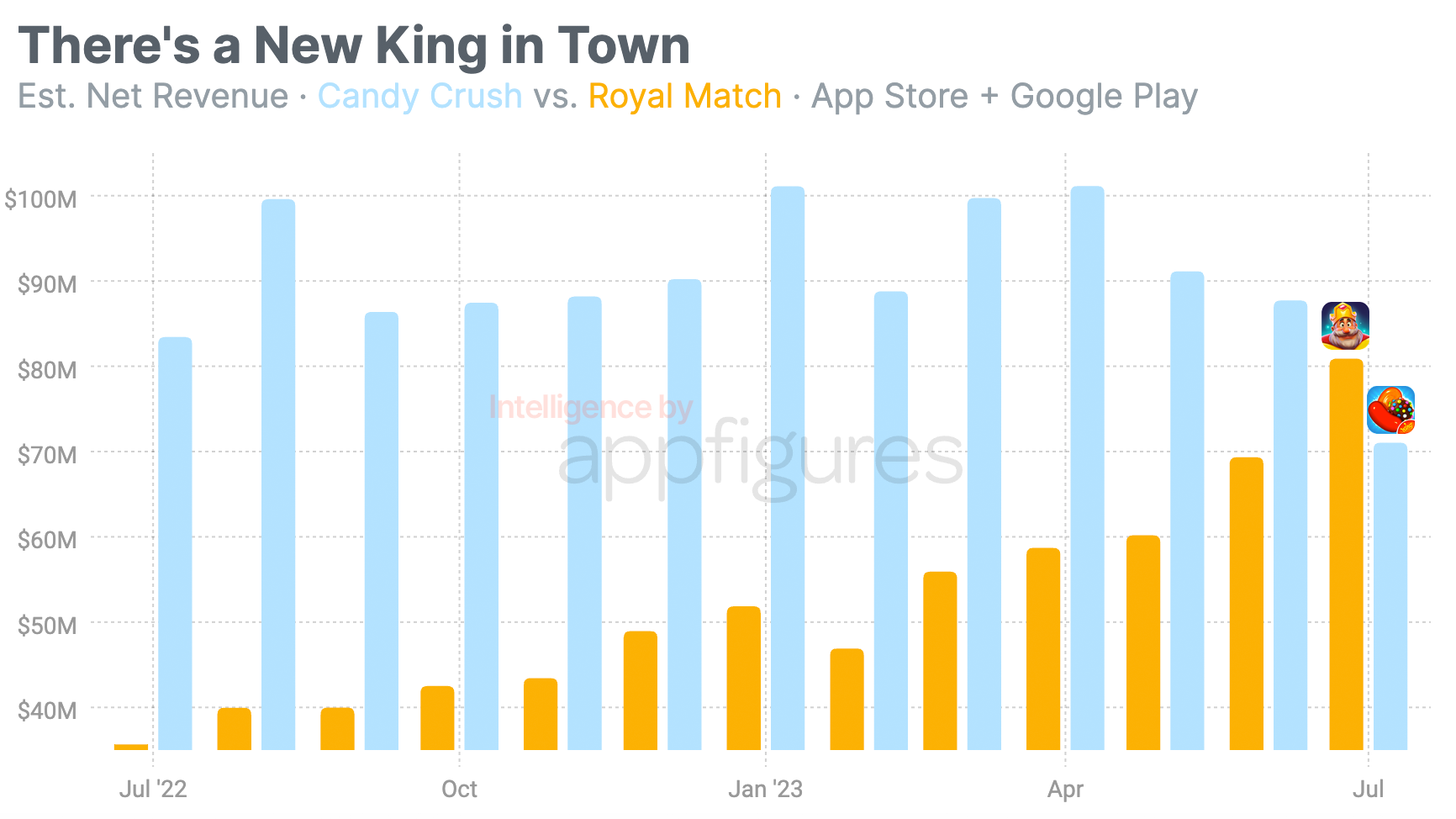

4. Royal Match Overtakes King's Candy Crush for the First Time

Candy Crush Saga has been the King, no pun intended, of matching games for a loooooong time. But good things can't go on forever.

New(ish) competitor Royal Match, which rolled out in 2020 and some say is a more exciting game, has been growing steadily.

Royal match is no match - pun definitely intended - to Candy Crush in terms of revenue, but that ended last month.

Over the last 12 months, Royal Match's revenue rose 125%. Last July, our estimates show Royal Match raking in $36M of net revenue from the App Store and Google Play. The majority came from the App Store, where Royal Match has been one of the top grossing games throughout.

Royal Match ended July with $81M of net revenue. And that's what Turkey-based Dream Games, the game's publisher, gets to keep after Apple and Google take their fees.

Candy Crush, on the other hand, earned $83 last July, according to our estimates. Although revenue has been fairly consistent this year, the last few months have seen a decline.

After peaking at more than $100M in April, Candy Crush Saga's revenue dropped to $91M in May, then $87M in June, and in July, revenue dropped to just $71M.

Just in time for Royal Match to take over.

Game developers - Don't be afraid to challenge the king.

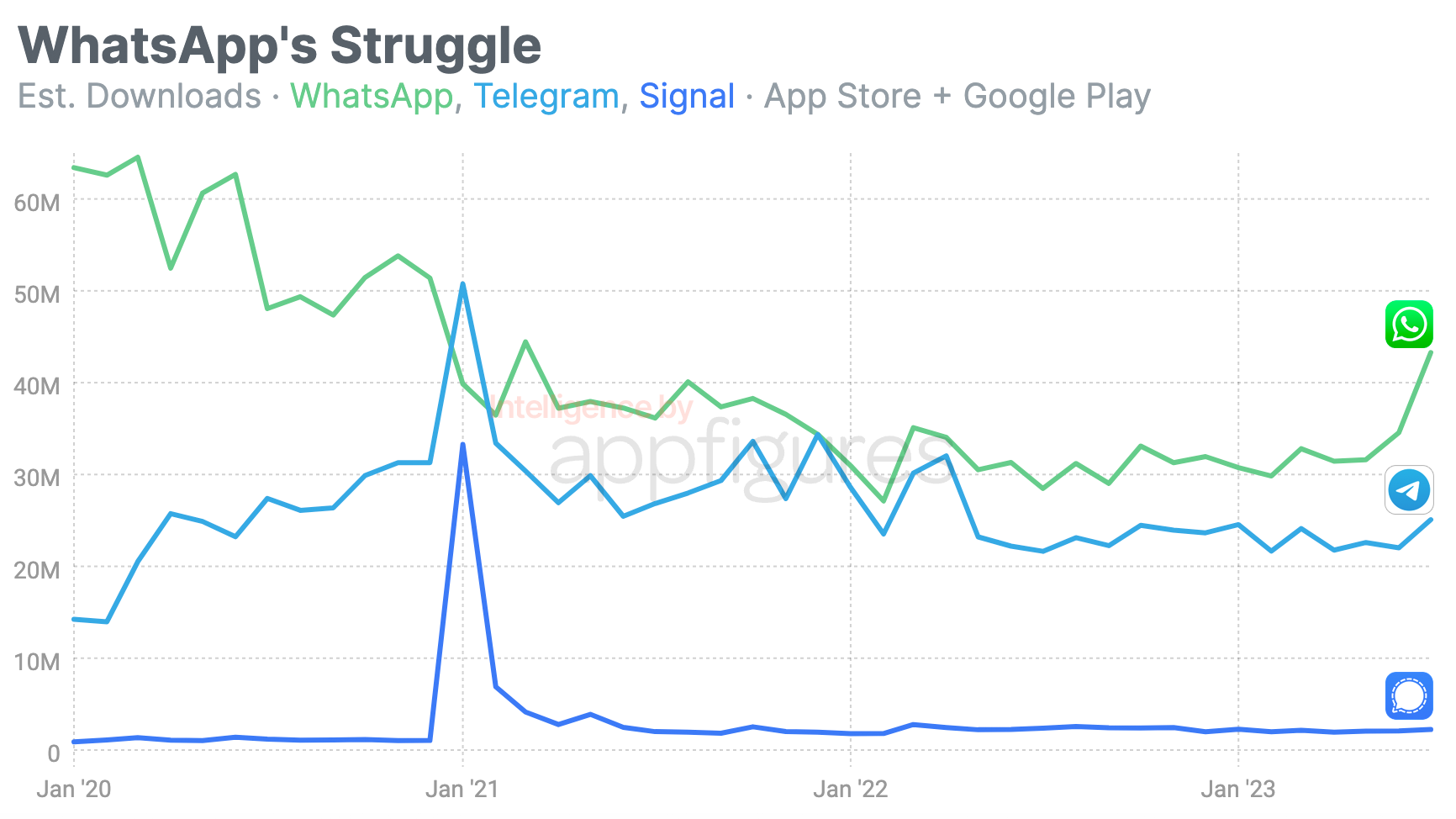

5. WhatsApp's Multi-Year Download Decline Finally Stopped

Meta's WhatsApp, the messenger that's so popular outside of the US some governments rely on it to communicate, has been on a serious downloads slump in the last few years.

Which makes sense - so many people have WhatsApp already + the app comes preinstalled on many Android devices new downloads dropping isn't a serious surprise.

Well, that seems to be changing now.

Since 2020, WhatsApp's monthly downloads dropped by 50%. Our estimates show 63M downloads in January of 2020 and just 31M in January of 2023.

"Everyone has WhatsApp" doesn't really cover such a drop...

Competition from Telegram and Signal, which was co-founded by WhatsApp's co-founder, has taken chunks of users away users at a constant pace in 2020 and 2021 after a mistake by WhatApp and calls from many leading figures in the privacy space to switch away.

Although both competitors are smaller in scale overall, their downloads grew when WhatsApp's shrunk indicating enough potential users decided not to try WhatsApp but instead to go with a competitor.

That loss could amount to as many as 50M new users that didn't go with WhatsApp!

Downloads eventually normalized for all three, but this summer, all three are now on the rise.

WhatsApp's downloads rose 34% since April and Telegram's 14%. In more absolute numbers, that's 43M for WhatsApp and 25M for Telegram. Signal also grew, but its downloads are an order of magnitude smaller that it's less relevant.

And fun fact, even though WhatApps isn't as popular in the US as it is outside of the US, on the App Store, the US is WhatsApp's biggest driver of downloads. That isn't the case on Google Play, where India dominates. The downloads there are also 5x those of the App Store.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.