This Week in Apps - Subscriptions Much?

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs 30 days ago)

Insights

1. How Many iOS Apps Monetize with Subscriptions?

Subscriptions are a great way to make money with your app (or game). Many developers know that by now, but how many apps (and games) are monetizing with subscriptions?

We recently added the option to find apps that use subscriptions to Explorer, our market research tool, and I used that to analyze the App Store and see how prevalent subscriptions are.

FYI - We don't have this filter for Google Play yet, so this analysis is focused on the App Store. I'll do the same for Google Play once we add that to Explorer.

As of right now, 232K apps and games are offering at least one recurring in-app purchase (aka subscription) on the App Store. That means 15% of all apps and games available on the App Store right now offer a subscription.

Can you guess how many of those are paid apps? The number is higher than I expected. By a lot! I'll get to it below, so you have time to guess.

Which categories have the most subscription apps? Well... you might find this surprising. It's games.

The category with the most subscriptions is the games category which has 31% of all subscription apps in the App Store.

Looking at the list of games with subscriptions, which includes pretty much all the Top Grossing games, I'm not too surprised it's the biggest category.

It took a little bit for games to figure out subscriptions but once they did the floodgates opened, and the revenue is there to justify it.

According to our App Intelligence, more than 1,500 of those games earned more than $100K in the last 30 days, and that's net which means what the publishers of those games get to keep after giving Apple its share.

Education is the second largest category with subscriptions at 13% followed by Utilities at 7%.

Health & Fitness, Entertainment, Productivity, Lifestyle, Photo & Video, and Social Networking follow with a single-digit share.

The category I expected to be in the lead, Business, came in 10th with just 3% of subscription apps. At first glance, it feels wrong, but if you consider many of the apps in the business category are clients for platforms that charge on the web, this makes a lot more sense.

So far this year the App Store has seen between 3K-4K new iOS apps (and games) every month. How do you think this number will change in 2024?

Oh, and if you guessed 7.5K apps are both paid and offer a subscription you'd be right. This number was a bit of a surprise for me. Games lead the way, again, followed by Education and Utilities.

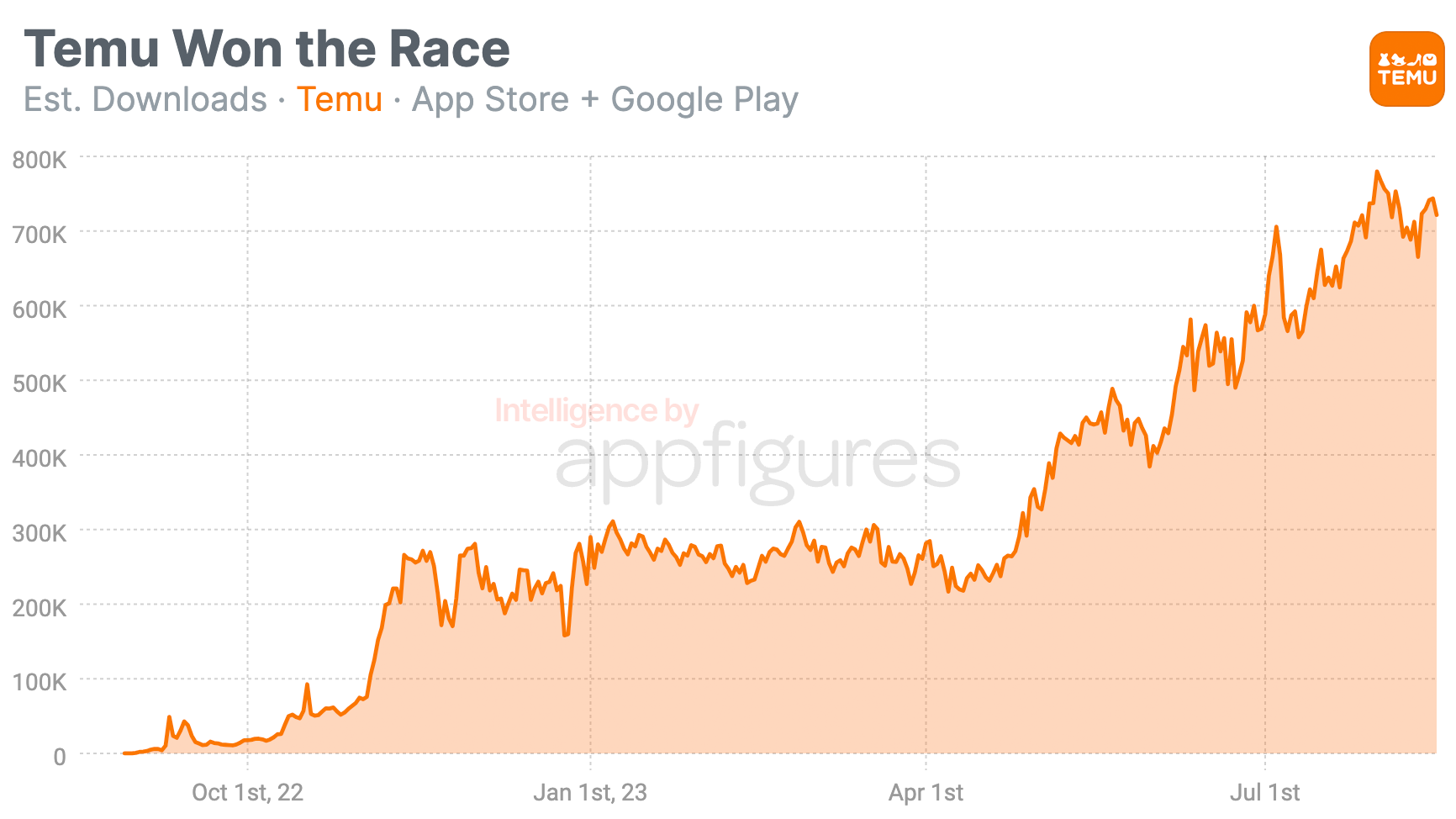

2. Temu Hits a Big Milestone Ahead of First Birthday

Temu, the shopping sensation that's taken over the App Store, is about to celebrate its first birthday. And it's got a pretty nice gift waiting for it.

In the last few days, Temu crossed a big milestone - 100,000,000 downloads.

If you've been watching the top charts you'd see Temu staring all the way up top. It's currently the top result in the App Store and Google Play, and that's been its "normal" state for quite a while now.

A few apps like ChatGPT knocked it down for a few days here and there, but thanks to what feels like an infinite ad budget, Temu continues to be the top download.

According to our estimates, in the last month Temu has been averaging 700K new downloads every day from the App Store and Google Play. A little more than half of those are coming from the US while the rest are spread across many other countries.

This growth is relatively new. In January, Temu, which launched last September was seeing just about 250K downloads a day, according to our estimates. That might sound like a lot, and it is, but it's just about a third of what the app is seeing now.

Temu's climb started in March and has been rising consistently since.

The app is embroiled in controversy, which feels like par for the course with apps coming from China these days. The government wants to close a loophole that's enabling Temu to ship items cheaply and users are going on TikTok with claims that Temu sold their billing info to scammers.

But that hasn't stopped the downloads.

3. The Top 10 Highest-Earning Games in The World Brought In more than $500M in July

I crunched the numbers and ranked the highest-earning games, as I do every month, but this time I expanded beyond the US and ranked the highest earners globally.

Like apps, the top games are the usual suspects that are ranking high in the US, but unlike games, there are more titles on this list from China!

Let's have a look at the numbers, and titles, for July.

Monopoly Go was the highest-earning game in the world in July. It added $84M of net revenue to its bottom line, according to our estimates. And that's net which means what Scopely, the game's publisher, gets to keep after Apple and Google take their fees.

I covered Monopoly Go several times since its release in April because it operates at a scale that hasn't been seen before. It dethroned YouTube and TikTok to become the highest-grossing game in the US recently and it doesn't seem to be dropping.

Royal Match came in second, earning $81M in July, according to our estimates, and again, that's net. Candy Crush Saga, Roblox, and Pokemon Go round out the top 5.

On the App Store side, China was responsible for 3 of the top 10 games in July for a total of $102M. What's interesting here is that most other titles are available globally while those are only available in China.

China's App Store has grown over the last few years to become a superpower that easily competes with the US. That's probably why the Chinese government is about to start regulating apps in the country.

Our App Intelligence shows that together, the top 10 highest-earning games in the world brought in $563M of net revenue in July.

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

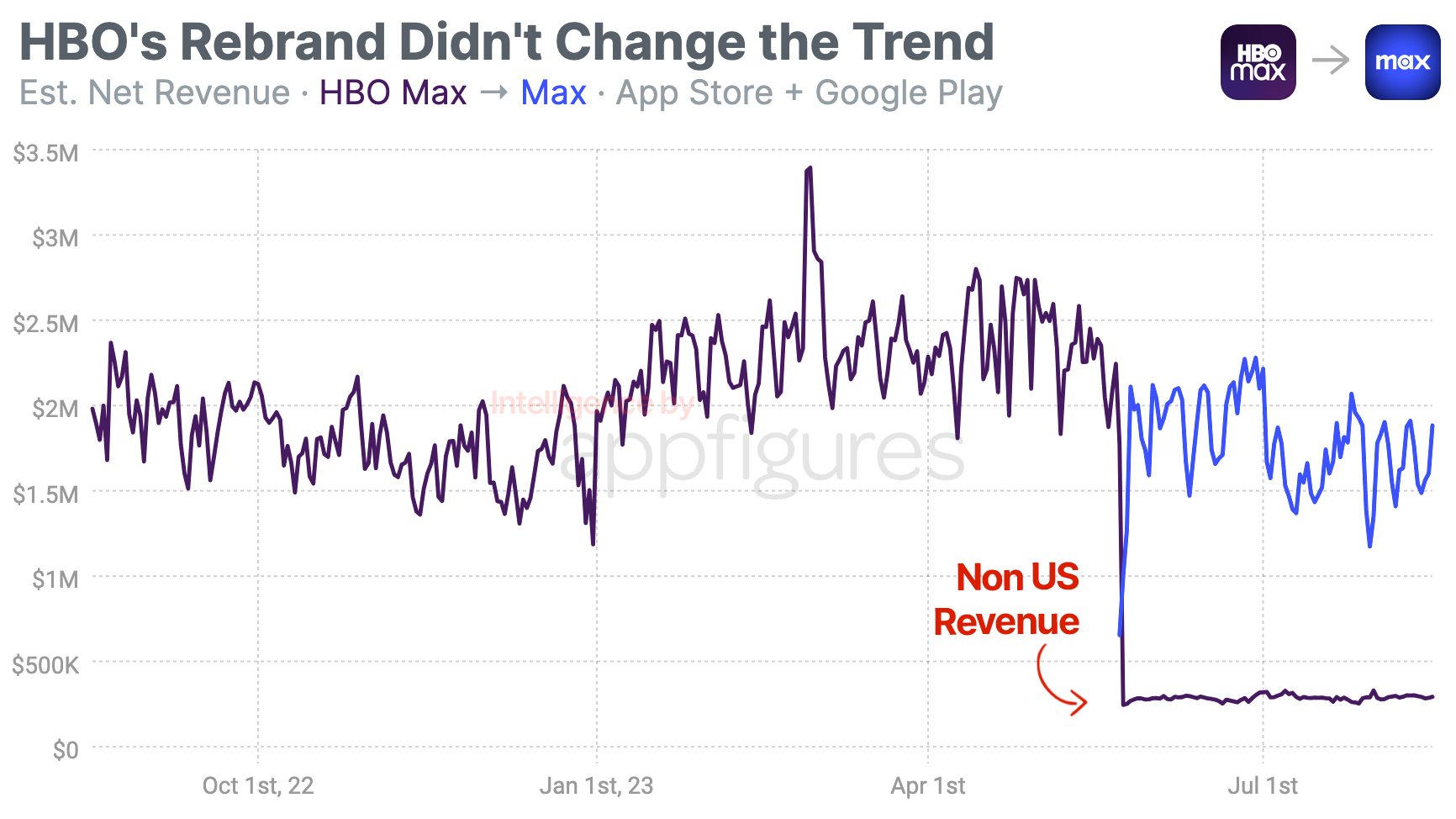

4. Was HBO Max's Rebrand Worth It? A Look at Revenue Before and After

A few months ago HBO Max, one of the highest-grossing app in the US, rebranded into Max. But this wasn't a simple name change - Max is a new app that's only available in the US while HBO Max is still available outside of the US.

Oh, Max also got discovery+'s catalog of shows.

But here's the question - did the rebrand help or hurt the streamer?

Looking at the app's mobile revenue before and after the rebrand the answer is...

The simple answer is that it doesn't look like it.

This year has been pretty positive for HBO Max. So far in 2023, HBO Max (pre rebrand) averaged $2.3M in daily net revenue. Yes, daily! That was before the rebrand.

Once HBO Max turned into Max, the old app was removed from the App Store and Google Play in the US. Non US revenue is now all that's left and it's at around a 10th of the total from earlier in the year.

Brazil, Mexico, and Spain are the top markets by revenue, and there, revenue remained fairly consistent. Which makes sense - nothing happened there.

In the US, revenue dropped a visible amount. Although it didn't happen right away, revenue has been on the decline for a few weeks now.

Our estimates show that Max averages $1.9M/day, and the trend isn't pointing up. At all.

This revenue "leak" is a reminder that content is still king, and HBO hasn't had any real blockbusters recently. Combine that with the return to movie theaters and you can see Max needs to do more to expand its offering, and discovery+ content isn't "it".

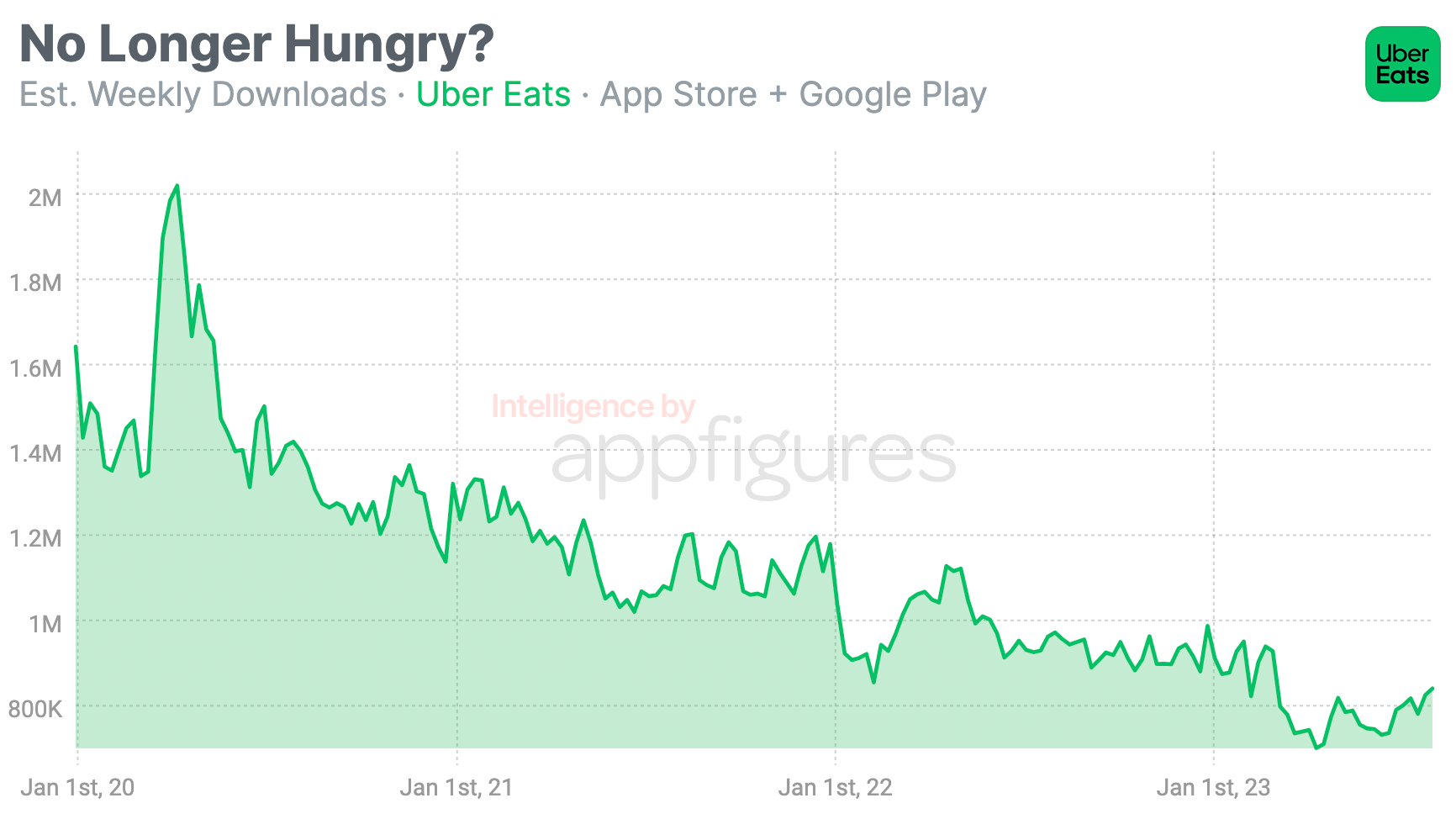

5. Uber Eats Struggles To Maintain Traction Internationally

Uber Eats, the food delivery service, has seen downloads for its flagship app drop by 50% since 2020.

Does everyone have the app already? Are the rest not hungry? Not lazy?

Let's take a closer look at downloads.

Uber Eats started 202 with 1.6M weekly downloads, according to our estimates. That's quite a nice number, and it isn't even the peak for Uber Eats. That came during the early days of lockdowns, when Uber Eats peaked at 2M weekly downloads.

But if we take out that spike, it's clear downloads have been on a downward slope. By the end of 2020, pandemic and lockdowns and all, downloads dropped to 1.3M. By the end of 2021, the figure downloads dropped to 1M, and by 2022 things stabilized a bit and downloads dropped just a bit more to around 900K. It dipped even lower last week.

Why? Pre pandemic, Uber Eats was mostly free for users. There were no delivery fees by restaurants or black box fees charged by Uber. The consistent decrease in downloads could be a result of that.

But there's another way to look at this - countries.

Uber Eats operates in and out of the US, and most of its downloads don't come from the US. Japan, the UK, Brazil, and Mexico are also big for Uber Eats. Not a single country is larger than the US, but together they are - in terms of downloads, that is.

Although downloads in the US have dropped this year they have been fairly consistent before. The main drop for Uber Eats comes from Mexico and Brazil, where downloads dropped 60% and 90%, respectively.

Since 2020, Uber Eats saw 14.4M downloads in Brazil, 16.1M in Mexico, and 57.3M in the US. I expect to see more focus on the US as other markets become more challenging.

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.