This Week in Apps - Streaming Stagnation

This Week in Apps is a short, no-fluff, round-up of interesting things that happened in the mobile industry. Here are our top highlights.

U.S. Revenue Index (vs. 30 days ago)

Insights

1. Is There a New Wordle on the App Store?

I noticed a new word game climbing its way up the most downloaded chart on the App Store this week, and looking at the trend and timing, we could have a new Wordle here.

Cryptogram is a word puzzle where the user needs to find missing letters in famous quotes. It's not at all like Wordle, but it seems to be catching on much like Wordle did before it went viral.

Cryptogram, which I'm pretty sure is only available on the App Store but has an identical clone on Google Play, was the #2 most popular game in the US App Store last week.

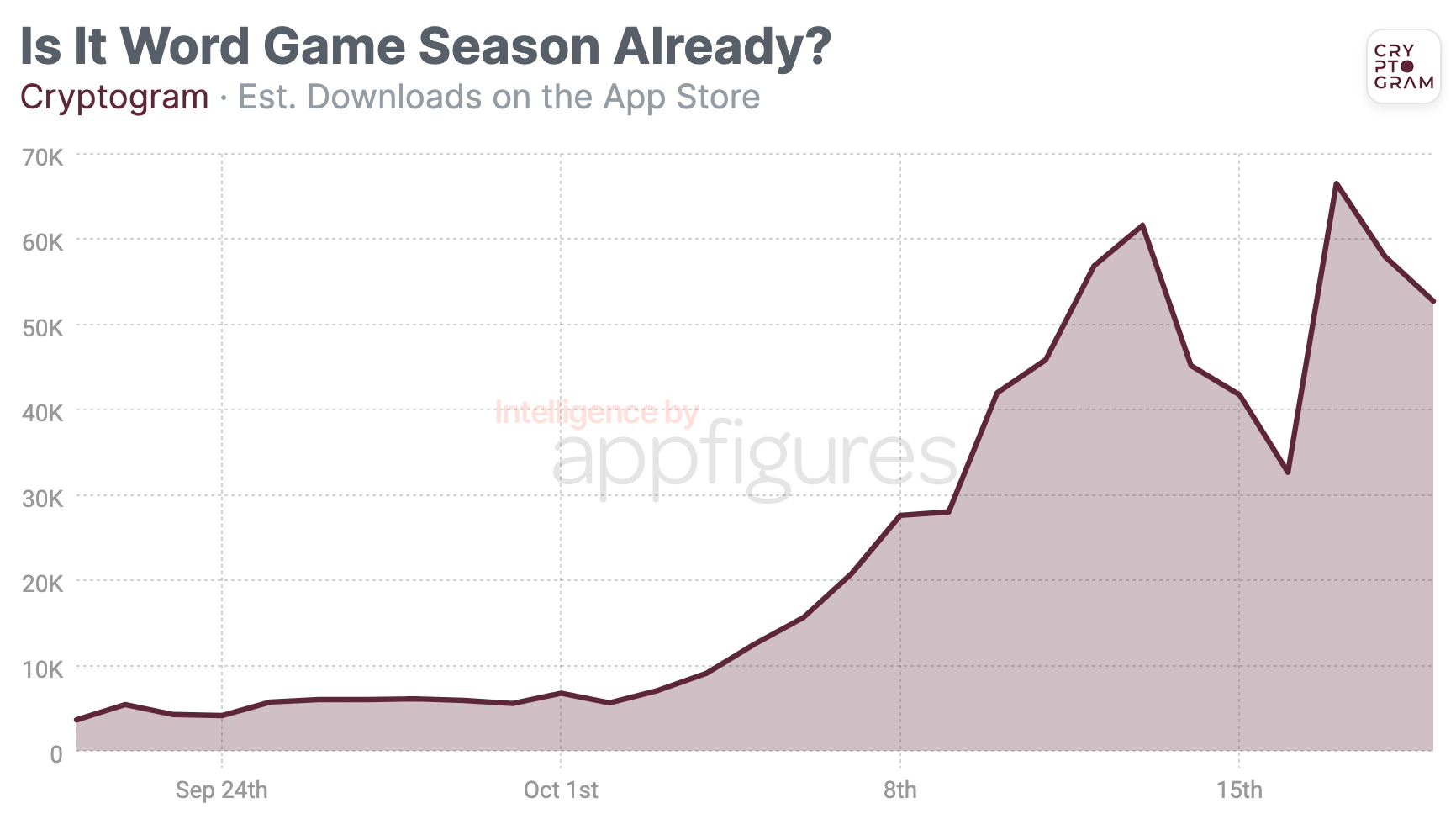

In terms of downloads, Cryptogram was averaging 3K downloads in September and started seeing growth in October.

Last Friday, downloads ballooned to 62K, according to our estimates. That's a whopping 19.7x increase within just a few weeks.

But that wasn't all - downloads grew even more last Tuesday to 67K!

According to our estimates, Cryptogram made its way into 636K iOS devices in October. Up from 105K in September and just 3.7K in March.

But something is missing...

Unlike Wordle, and potentially why Cryptogram won't go viral, the game doesn't encourage social sharing, which was how Wordle spread like wildfire.

It looks like momentum is slowing down but there's still time to capitalize on active users by adding social sharing features - and integrating them into the game's flow - to turn this downward slope into a hockey stick.

2. Are 3rd Party ChatGPT Apps Still Making Money?

When ChatGPT launched without a mobile app it was clear someone would "fix" that, and it didn't take long for a barrage of 3rd party apps to roll out.

Ask AI and Genie were two of the most popular and within a very short period of time, were making a lot of money.

In May, OpenAI launched an official app for ChatGPT and the obvious question was obvious - will people continue to pay those 3rd parties?

Yes, people still continued to pay the 3rd parties because for many, especially the ones not in tech, ChatGPT was just a name and any app that had it was good.

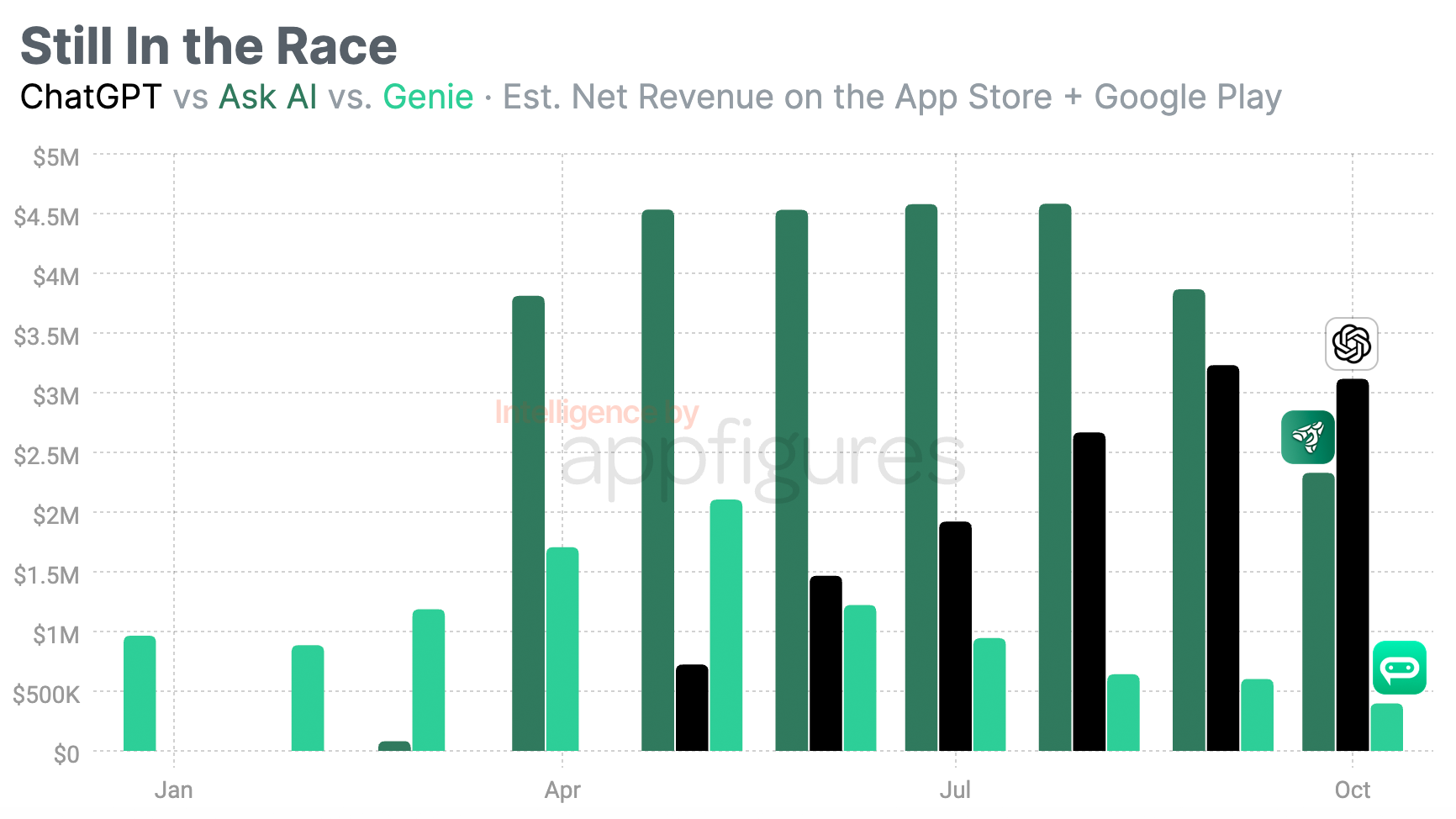

According to our estimates, Ask AI earned $3.8M of net revenue in April. Genie made $1.7M in April, and all of this is net which means what the publishers get to keep after Apple and Google take their share.

Both grew in May, to $4.5M and $2.1M in May. Massive numbers for apps riding the ChatGPT craze.

The official ChatGPT launched on the App Store in May, and the competition split in two directions. Genie started sloping down while Ask AI's revenue continued strong.

Fast forward a few months and things aren't looking as great. Although Ask AI makes more revenue than the official ChatGPT app, it took a massive hit in September and our projections show October will continue the drop.

In numbers, Ask AI's $4.6M of net revenue in August dropped to $3.9M in September. Genie's 2.1M in May has now shrunk to just $400K.

A big component of the growth of both was paid ads across many different channels, and that seems to have subsided in recent times. I wonder if the drop is a self-fulfilling prophecy or a reaction to dropping ROI.

But - I still believe there's more to ChatGPT than a textbox...

3. Movie Theaters Are (Finally) Back in Business

Demand for AMC's mobile app rose to a new all-time high. Not just post-pandemic but overall!

And the numbers are pretty big.

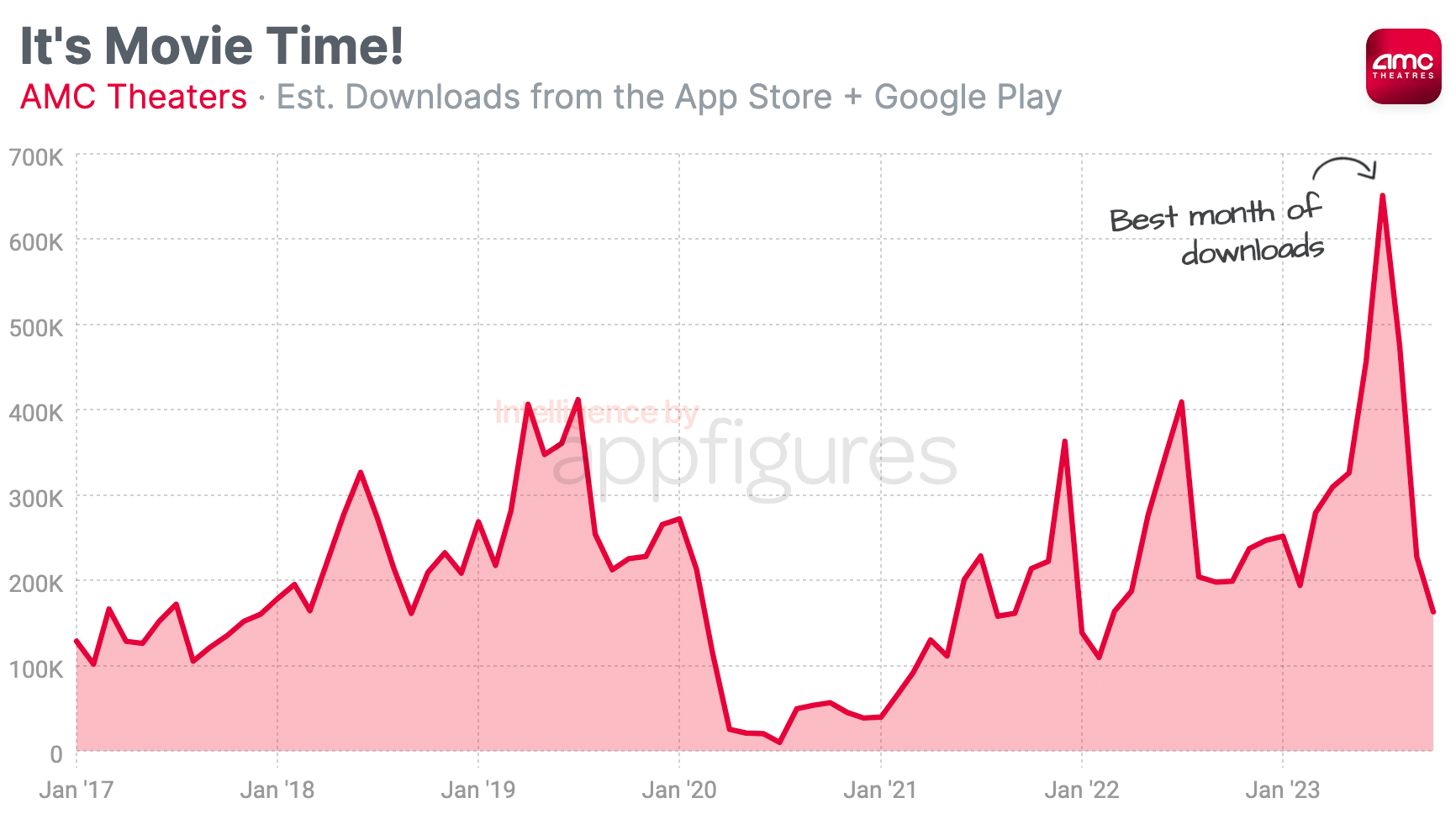

Pre-pandemic, the app's highest month of downloads was July of 2019 when the app saw 412K downloads. Then the pandemic happened and downloads dropped to just 10K in July of 2020.

I'm not going to even calculate the percentage because it'll be a very sad number.

And downloads are a fairly good proxy for people going to the movies because these days most purchasing is done via app, which is convenient for moviegoers and analysts.

2021 showed good signs of recovery with 229K downloads in July, according to our estimates.

The trend was also looking positive, and in July of 2022, downloads rose to 409K. Almost double year over year, and almost beating the all-time best from 2019.

Downloads in 2023 grew even more, and since we're looking at first-time downloads, this means even more people are going to the movies. July ended with 651K downloads from the App Store and Google Play - though most from the App Store.

And even though 2023 hasn't ended yet, downloads for the year are already higher than 2020, 2021, and 2022 - and are on track to beat 2019.

This is great for an industry that was hit hard, and I hope it'll also mean we can expect more new movies in the near future.

I'm also pretty sure this is bad news for streaming services...

Grow Smarter, with Data.

Affordable tools for ASO, Competitive Intelligence, and Analytics.

4. HBO's Rebrand Hasn't Changed the Trend...

2023 has been a weird year for streaming. After the amazing growth services like Disney+ and HBO Max saw during the pandemic, where demand hit peak, the last couple of years have proven to be more challenging.

Demand has subsided as more people chose fresh air over screens while at the same time, more competition sprouted bringing new content and new choices, and a lot of what made titans like HBO and Disney grow - new exclusive content - wasn't streaming first but rather going to movie theaters.

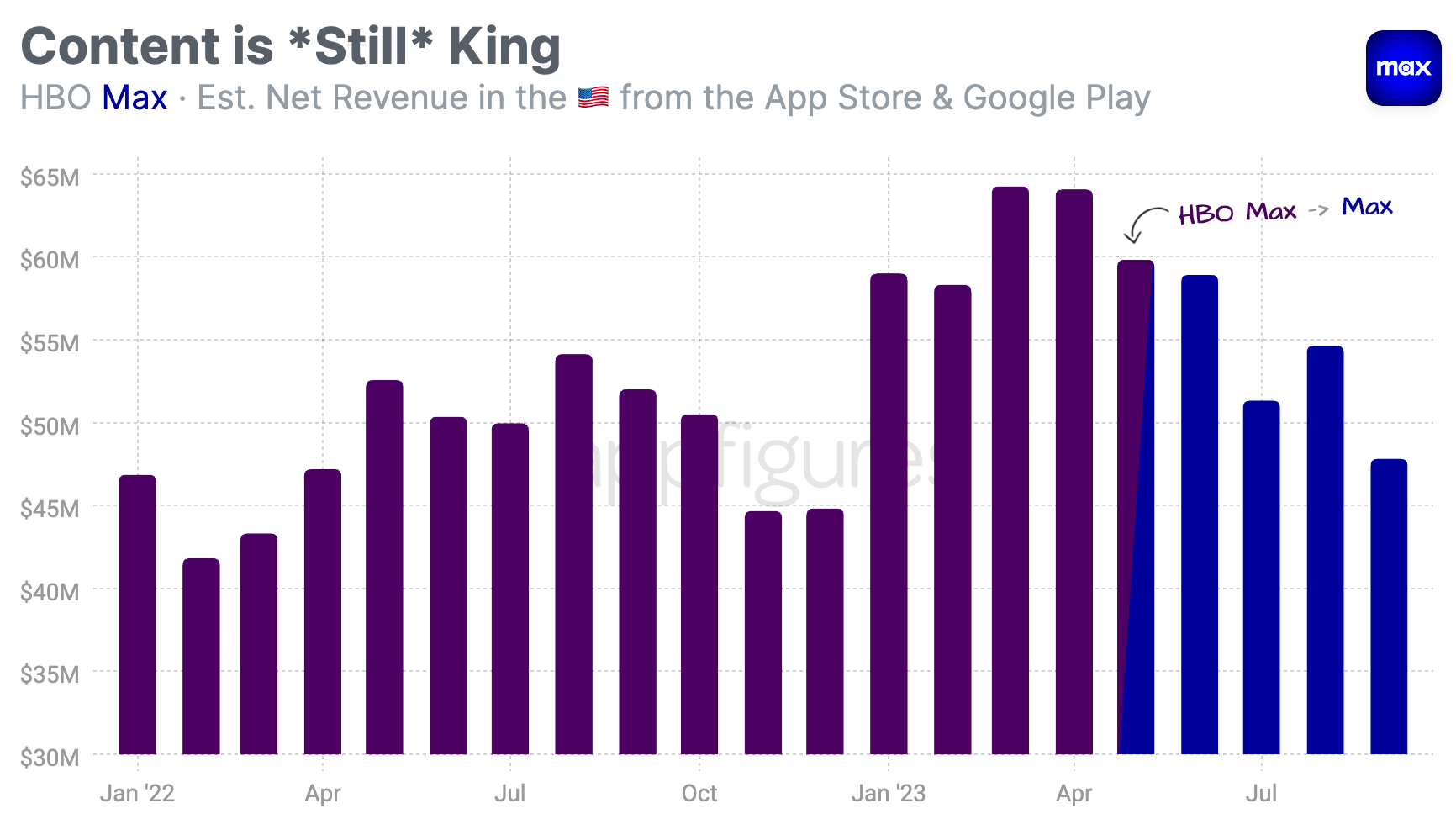

We can see the impact of all three on HBO's mobile revenue.

This year, HBO saw its mobile revenue grow for a bit but then started crashing.

According to our estimates, the streaming service started 2023 with $59M of net revenue from the US in January from the App Store and Google Play. That's roughly 25% higher than January of 2022.

February dipped a bit but net revenue from the US rose in March to $64M. Net means what HBO gets to keep after Apple and Google take their share. April continued strong with the same amount, but May dropped again.

In May, the app also rebranded from HBO Max to Max, swallowing the discovery channel in the process.

More content is more better, right?

Not really! Every month after saw a drop in revenue.

September was Max's lowest revenue this year - just $48M. And that's net revenue.

Subscription apps are all about Attention, Conversion, and Retention. And for streaming apps it all hinges on new and exciting content.

I haven't seen too much of that on HBO lately.

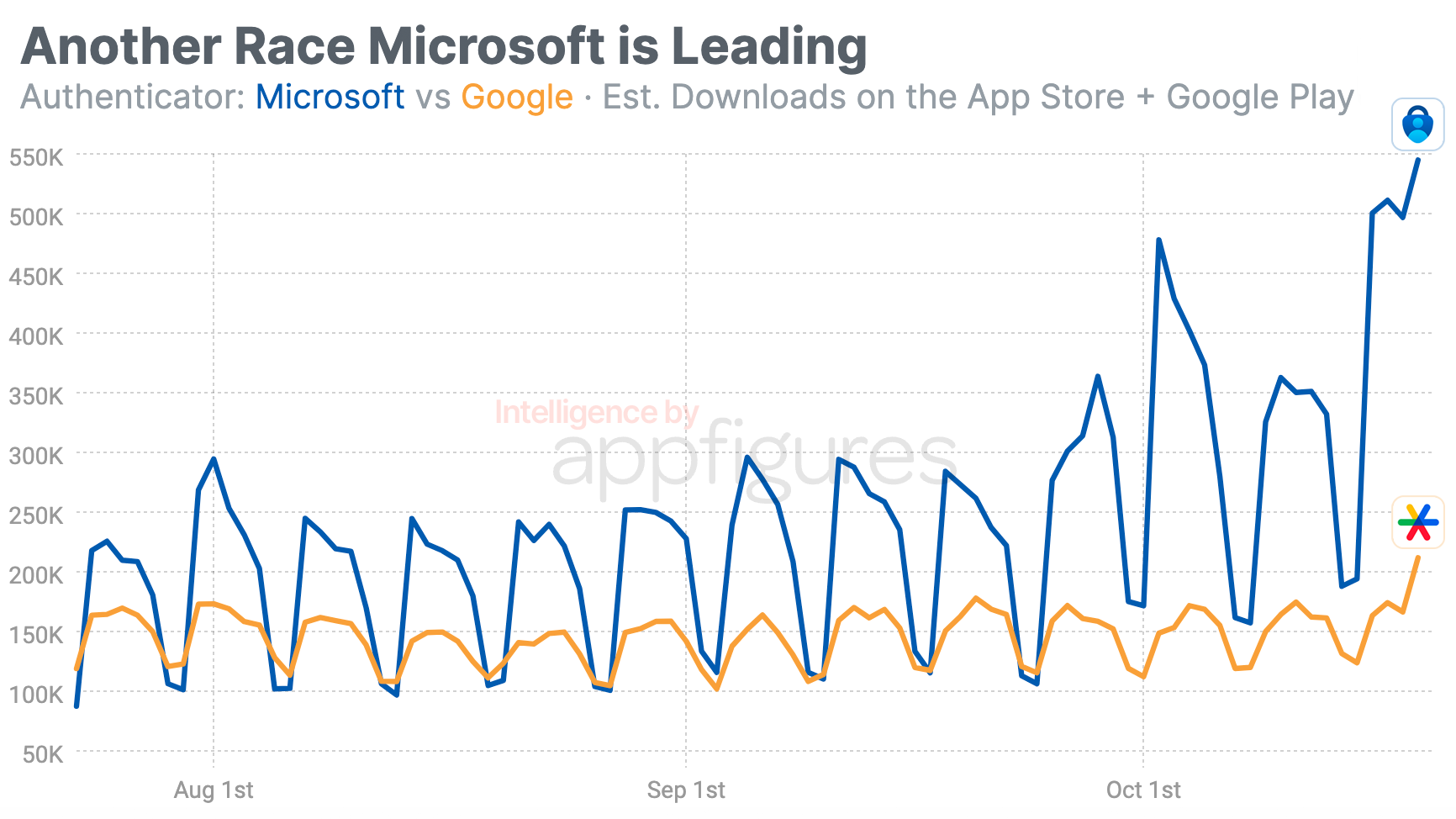

5. Microsoft is Winning Another Race

If you use 2 Factor Authentication for anything, and I suspect many of you do, you need an authenticator app.

The authenticator apps category is probably one of the least exciting on the App Store and on Google Play, but! Need superceeds excitement.

How many downloads do you think authenticator apps even get per day? Try to guess before looking at the chart.

Easy answer - A lot more than you'd expect!

Microsoft and Google publish the two most popular authenticator apps.

Google's, which was released all the way back in 2010, went stale for a long time with little to no updates and lacking big features that made it convenient. Recently, however, the app got a major update and some of those big features it was sorely lacking.

Microsoft joined the arena in 2015 and has been a bit more active.

Unlike Google' authenticator, Microsoft's has been growing in popularity over the last few months. Slowly during the summer, but over the last couple of weeks, a lot faster.

In more absolute terms, Microsoft Authenticator saw downloads rise from 1.1M downloads per week in July to 2.1M downloads last week, according to our estimates.

Yes, more than two million people all around the world downloaded Microsoft's authenticator app last week. That's a lot more than I'd expected.

I wasn't sure if this surge was specific to Microsoft or if it was an increase for all apps so I compared it to Google Authenticator.

According to our App Intelligence, Google Authenticator's downloads didn't really change much between July and last week - both with roughly a million downloads.

I've used a bunch of different authenticator apps over the years but haven't used Microsoft's yet. Clearly, I'm in the minority.

Messaging, Authenticators, what's next?

App Intelligence for Everyone!

The insights in this report come right out of our App Intelligence platform, which offers access to download and revenue estimates, installed SDKs, and more! Learn more about the tools or schedule a demo with our team to get started.

Are you a Journalist? You can get access to our app and market intelligence for free through the Appfigures for Journalists program. Contact us for more details.

All figures included in this report are estimated. Unless specified otherwise, estimated revenue is always net, meaning it's the amount the developer earned after Apple and Google took their fee.